Term vs. Whole Life Insurance: Which One Is Right for You?

Whole life offers lifetime coverage and cash value, but it’s often misunderstood. Learn the real tradeoffs vs term life, when permanent insurance can make sense, and how to avoid expensive mistakes.

The term vs. whole life debate is one of the most confusing topics in personal finance. Term life is pure protection for a set time. Whole life is lifetime coverage with a cash value component. Both can be useful—but they solve different problems and come with very different costs.

Term Life: Pure Protection

Term life insurance is designed to protect your family during specific years: raising children, paying a mortgage, building savings, and stabilizing income. You pay a premium, and if you pass away during the term, your beneficiaries receive a death benefit.

Whole Life: Lifetime Coverage + Cash Value

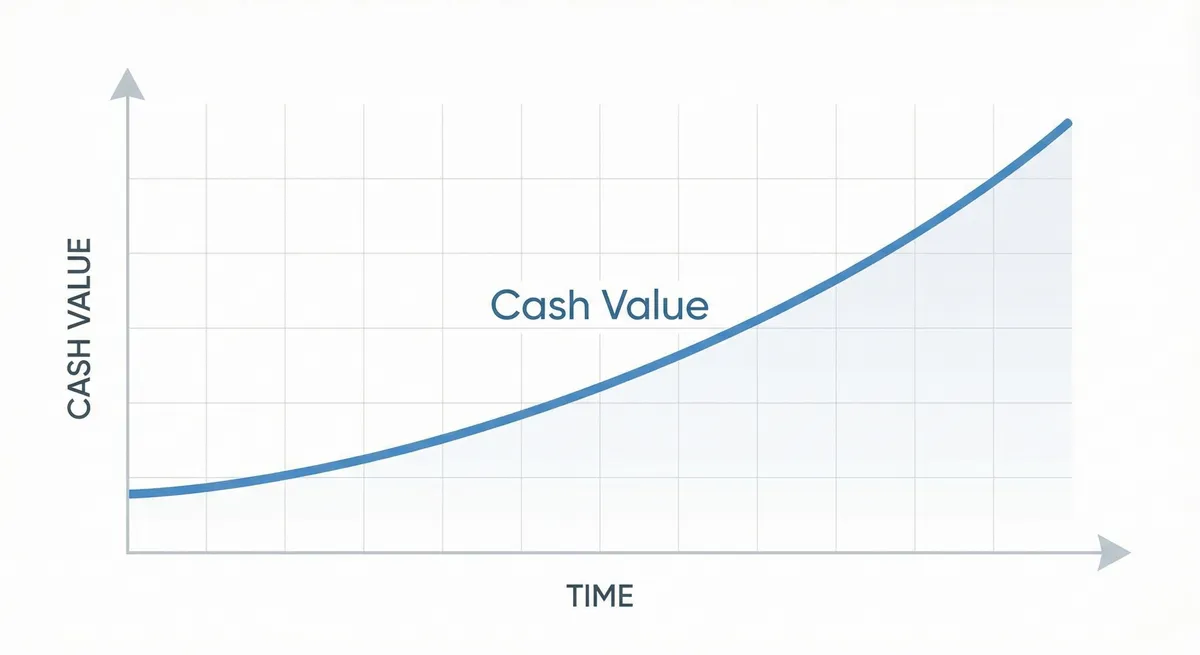

Whole life insurance typically lasts your entire life (as long as you pay premiums). It also builds cash value—a component that grows over time and may be accessed via loans or withdrawals (policy-dependent). Whole life is significantly more expensive than term for the same death benefit.

The Real Tradeoff: Cost vs. Guarantees

With term life, you buy affordable protection and invest the difference elsewhere (retirement accounts, brokerage, etc.). With whole life, you pay higher premiums for lifetime guarantees and the cash-value structure. The question isn’t “which is better”—it’s “which problem are you solving?”

When Term Life Often Makes Sense

- You need high coverage for dependents at the lowest cost.

- You’re prioritizing retirement investing and emergency savings.

- You want simplicity and clear financial planning.

When Whole Life Can Make Sense

- Estate planning needs: Cover estate taxes or create guaranteed liquidity for heirs.

- Lifetime dependent: You support someone with special needs long-term.

- Business planning: Certain buy-sell agreements or key-person structures.

- Highly disciplined savings alternative: For someone who consistently under-saves (still compare options carefully).

Common Sales Traps to Watch For

- “It pays for itself”: Premiums are real money; cash value growth takes time.

- Illustrations vs. reality: Projections may assume dividends that are not guaranteed.

- Under-insuring: Buying a small whole life policy may leave your family underprotected.

A Practical Strategy Many Families Use

Some households buy term life to cover major income protection needs, and later consider a smaller permanent policy if lifetime goals appear (estate planning, legacy, etc.). This keeps protection strong while maintaining flexibility.

Quick Checklist

- If you need maximum coverage at minimum cost, start with term.

- If you’re considering whole life, clarify the exact problem it solves.

- Ask for a clear cost breakdown and compare alternatives.

- Ensure beneficiary designations match your plan.