When Annual Fees Make Sense: A Practical Credit Card ROI Checklist

Annual-fee cards can be a great deal—or a costly mistake. Learn how to calculate real ROI from credits, perks, and rewards, and decide if a no-fee setup wins for you.

An annual fee isn’t automatically bad. It’s a pricing model:

- No-fee cards earn your loyalty with simplicity

- Fee cards “pre-sell” value through perks, credits, and elevated rewards

Your job is to measure real value you’ll actually use.

Step 1: The only formula that matters

Net Value = (Rewards uplift + perks you use + credits you would have paid for anyway) − annual fee

If net value is positive and you’ll use it with low effort, it can be worth it.

Step 2: Separate “real credits” from “coupon book credits”

Credits fall into two buckets:

Real credits (high-quality)

These match your normal spending:

- travel credit you would pay anyway

- airline incidental credit you reliably use

- streaming credit you already pay for

Coupon book credits (low-quality)

These require behavior changes:

- monthly credits that force specific merchants

- complicated enrollment steps

- “use it or lose it” credits you forget

Rule of thumb: Only count credits you’re 80–90% sure you’ll use.

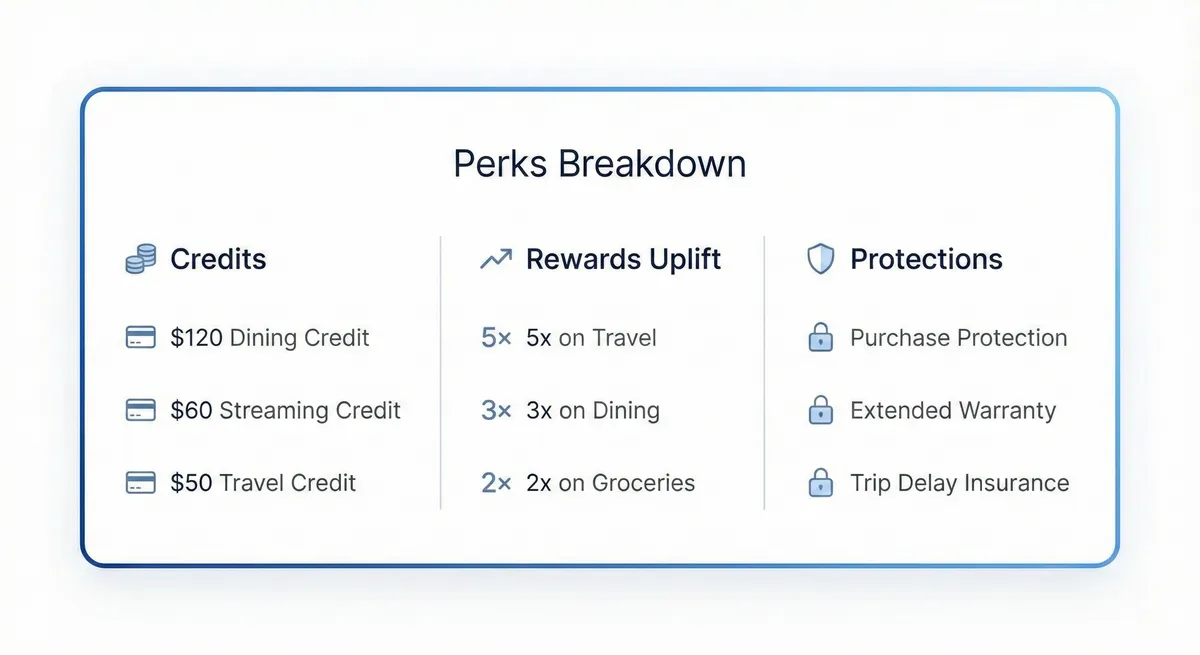

Step 3: Rewards uplift — the quiet value

A fee card may earn more in key categories. Compare your current baseline to the fee card.

Example:

- You currently earn 2% cash back on $2,000/mo spend = $480/year

- Fee card earns an extra 1% on $1,000/mo of that spend = +$120/year If the annual fee is $95, the rewards uplift alone might justify it for your spend pattern.

Step 4: The perks that actually matter

Some perks are useful, but only for specific lifestyles:

Travel perks (valuable if you travel)

- lounge access

- baggage/per-trip protections

- rental car coverage

- travel delay/cancellation protections

Everyday perks

- extended warranty

- purchase protection

- cell phone protection (if you pay bill with the card)

Don’t overpay for perks you won’t use.

Step 5: A fast ROI checklist (use this before applying)

Score each item as Yes/No:

- I will use at least one major credit consistently

- I will not carry a balance (no interest)

- I can explain the redemption value in one sentence

- The card fits my top 1–2 spending categories

- The perks match my actual lifestyle

- I won’t need 5 apps and monthly reminders to “win”

If you have 4+ Yes, fee cards might make sense.

Step 6: When no-annual-fee cards are the better play

No-fee often wins if:

- your spending is moderate

- you want simplicity

- you rarely travel

- you don’t want to manage credits

A clean no-fee setup can outperform a fee card you forget to use properly.

Bottom line

Annual fees are not “good” or “bad.” They’re a business deal.

If you can confidently capture more value than the fee—without effort and without interest—then it’s a good deal.