What Affects Car Insurance Premiums? The Real Pricing Factors and How to Lower Your Rate

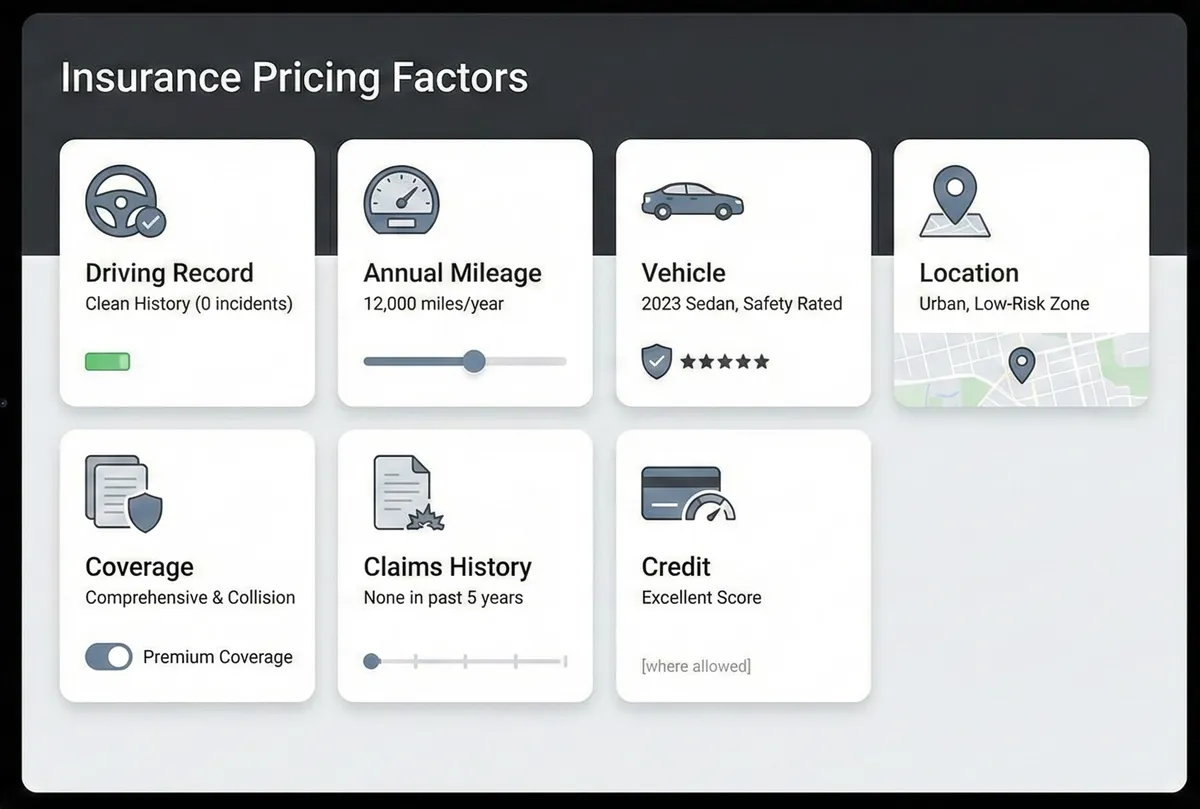

Why did your premium jump? We break down the biggest pricing factors—driving history, credit (where allowed), mileage, vehicle choice, and location—plus practical ways to reduce your bill.

If you’ve ever asked, “Why is my car insurance so expensive?”, you’re not alone. Insurers price risk using dozens of variables, and some changes can raise your bill even if you never had an accident. The good news: many factors are controllable, and small improvements stack into real savings.

The Big 7 Factors That Move Your Premium the Most

1) Driving Record

Tickets, at-fault accidents, and claims frequency are powerful predictors. One incident can impact pricing for years. Even “minor” speeding tickets can raise rates because they correlate with claim severity.

2) Location (ZIP Code)

Insurance is heavily local. Dense traffic, theft rates, weather risks, and repair costs all vary by area. Two drivers with identical profiles can pay very different premiums in different ZIP codes.

3) Vehicle Choice

The car you drive changes your premium because it changes potential payout: repairability, parts cost, theft risk, safety tech, and crash outcomes all matter. A “cheap” car can be expensive to insure if repairs are pricey.

4) Annual Mileage & Driving Patterns

The more you drive, the more exposure you have. Low-mileage drivers often pay less. If you shifted to remote work, updating your mileage estimate can be one of the fastest savings wins.

5) Credit-Based Insurance Score (Where Allowed)

In many states, insurers use a credit-based insurance score as a risk signal. It’s not the same as your credit score, but it’s influenced by similar behaviors (on-time payments, utilization, length of history). Some states restrict or prohibit this factor.

6) Coverage Selections

Higher liability limits, lower deductibles, and added coverages increase premium (often for good reasons). The goal is to balance protection and affordability without leaving dangerous gaps.

7) Claims Behavior

Frequent small claims can signal higher risk. Sometimes paying out-of-pocket for minor repairs keeps your long-term costs lower. Think in multi-year totals, not just this month’s bill.

How to Lower Your Car Insurance Rate (Action List)

Shop smart (and shop regularly)

- Compare multiple insurers with the same limits and deductibles for an apples-to-apples quote.

- Re-shop at renewal time if your premium jumps.

- Ask about professional, alumni, or membership discounts (some are real, some are tiny).

Use the right discounts (without trapping yourself)

- Bundle: auto + home/renters can reduce total cost.

- Telematics/usage-based: can be excellent if you drive safely and consistently.

- Good student / defensive driving: meaningful for some households.

- Pay-in-full / paperless: small but easy wins.

Adjust deductibles strategically

Raising deductibles can reduce premium, but only do it if you keep an emergency cushion. Your deductible is a “self-insurance” decision.

Reduce risk signals

- Keep a clean driving record (speeding is expensive over time).

- If you drive less now, update your mileage.

- Improve credit habits if applicable in your state (on-time payments and low utilization help).

When a Premium Increase Isn’t Your Fault

Sometimes pricing rises because repair costs, medical costs, and lawsuit severity rise across the market. Even perfect drivers can see increases in high-cost regions. In those cases, the best move is often: re-shop quotes, verify your details, and refine coverage choices carefully.

Checklist: Quote Like a Pro

- Same liability limits across insurers

- Same deductibles for collision/comprehensive

- Same drivers, vehicles, mileage, garaging ZIP

- Confirm discounts are actually applied in writing