Term Life Insurance Explained: How Much You Need, How Long, and How to Get the Best Rate

Term life insurance is often the smartest way to protect your family’s future. Learn how term policies work, how to choose coverage and length, and how underwriting affects your price.

Life insurance is not about “getting rich.” It’s about keeping your loved ones financially stable if you’re not there. For most families, term life insurance is the simplest and most cost-effective tool to protect income, pay off debt, and fund long-term goals like childcare or education.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period (the “term”), commonly 10, 15, 20, or 30 years. If you pass away during that term, the policy pays a tax-free death benefit to your beneficiaries. If the term ends and you’re alive, coverage typically ends (unless you renew or convert).

Why Term Life Is Often the Best Value

- High coverage for lower cost: You can often buy meaningful protection at a manageable premium.

- Simple structure: A clear goal—protect income during your highest-responsibility years.

- Flexible planning: Match the term to your financial timeline (kids, mortgage, debt payoff).

How Much Coverage Do You Need?

There’s no one-size-fits-all number, but strong coverage decisions follow logic. The goal is to replace your economic value, pay off major obligations, and give your family time to rebuild financial stability.

A Practical Coverage Framework

- Income replacement: Often 5–15 years of net income (varies by spouse income, savings, lifestyle).

- Debt payoff: Mortgage, personal loans, student loans (where applicable), high-interest debt.

- Childcare & education: Support costs that would shift to the surviving parent.

- Final expenses: Funeral and end-of-life costs.

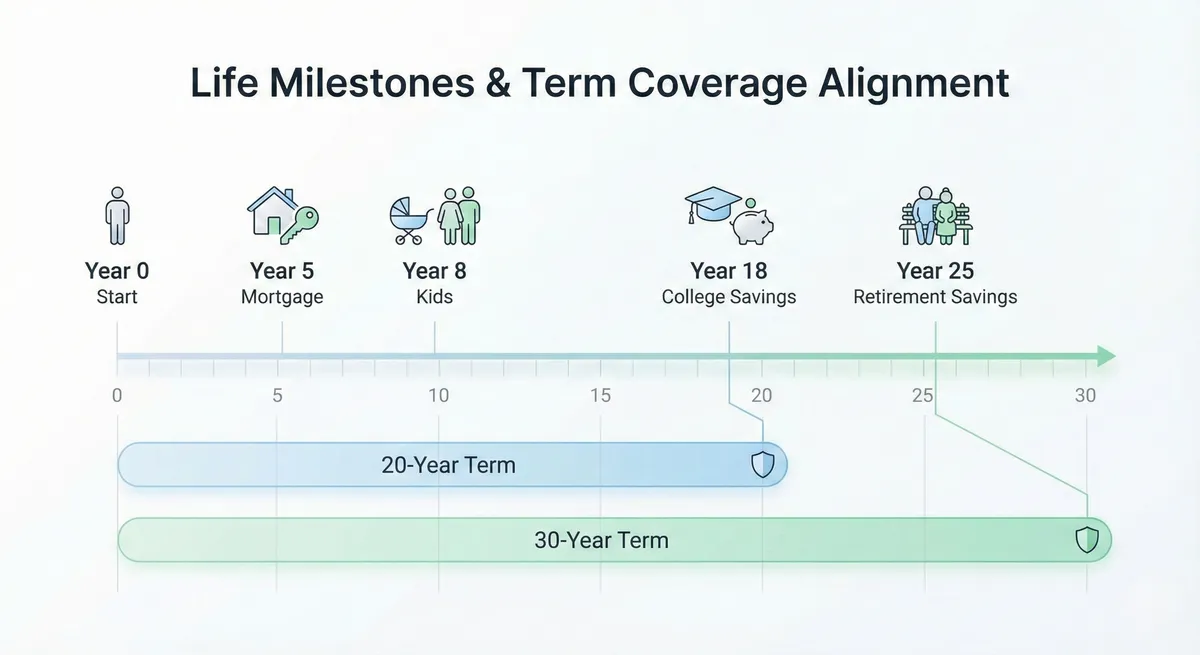

How Long Should Your Term Be?

The best term is the one that covers your “high responsibility window”—when your family depends most on your income.

- 20-year term: Common for families with younger kids and a long mortgage horizon.

- 30-year term: Useful if you’re buying coverage early and want to lock a low rate longer.

- 10–15 year term: Works for shorter debt payoff windows or later-life coverage needs.

Underwriting: Why Two People Get Different Prices

Life insurance pricing is based on risk: age, health history, smoking status, medications, family history, and sometimes hobbies. The healthiest strategy is to buy when you’re younger and healthier, because rates are generally locked for the term.

Ways to Improve Your Quote

- Quit nicotine products (including vaping) well before applying.

- Improve blood pressure and cholesterol with consistent habits.

- Apply when you’re stable (major health tests can affect underwriting).

- Compare multiple insurers—risk models vary.

Common Mistakes to Avoid

- Buying too little: A cheap policy can be useless if it doesn’t cover core obligations.

- Choosing a short term: Expiring coverage while you still have dependents can force expensive renewal.

- Overpaying for complexity: Many families don’t need permanent insurance to meet protection goals.

Quick Checklist

- Estimate coverage using income + debts + dependents costs.

- Match term length to kids/mortgage timeline.

- Get multiple quotes with identical settings.

- Name beneficiaries correctly and keep it updated.