What Is a Robo-Advisor? How Automated Investing Works (and When It Makes Sense)

A robo-advisor can build and manage a diversified portfolio for you automatically. Learn how the algorithm works, what you actually pay for, and who benefits most from hands-off investing.

A robo-advisor is designed for one job: make investing simple and consistent. Instead of picking stocks, you answer a short questionnaire and the platform builds a diversified portfolio—usually a mix of low-cost ETFs—then manages it automatically.

For many people, that “boring automation” is exactly what produces better results.

How robo-advisors work (in plain English)

Most robo-advisors follow a predictable system:

Risk questionnaire

You answer questions about time horizon, goals, and risk tolerance.Portfolio construction

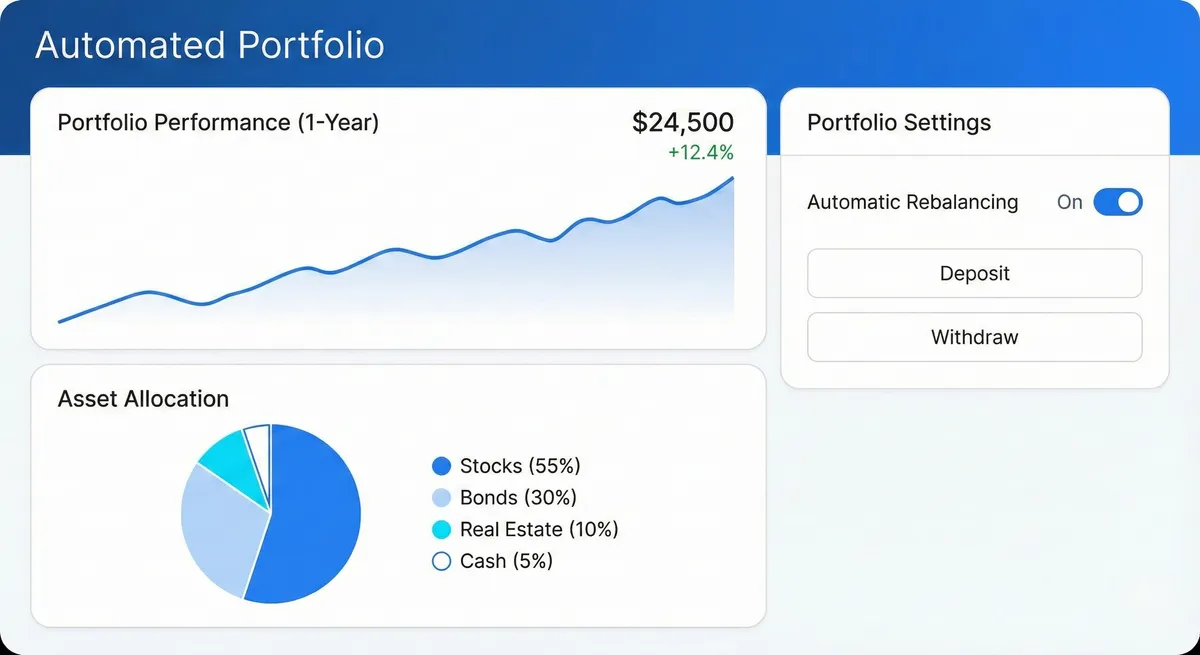

The platform assigns you an allocation (example: 80% stocks / 20% bonds) using diversified ETFs.Automation engine

It handles rebalancing, dividend reinvestment, and ongoing monitoring.Ongoing adjustments

Some robos also adapt your allocation as your goal date approaches.

What you’re paying for

Robo-advisor costs usually fall into two buckets:

1) Advisory fee

A small annual percentage of assets (often stated as “0.xx% per year”).

2) Fund expense ratios

ETFs inside the portfolio have their own built-in costs. You don’t get a separate bill—but they reduce returns over time.

Core features you should look for

A strong robo-advisor typically includes:

- Automatic rebalancing (keeps your risk aligned)

- Dividend reinvestment

- Goal tracking (retirement, home purchase, education)

- Automatic deposits / recurring contributions

- Tax features (depending on account type and platform)

When a robo-advisor is a great fit

Robo-advisors shine for people who want:

- A long-term plan without complexity

- A diversified ETF portfolio without manual work

- Automation that reduces emotional decisions

- A “set it and keep going” system

If you frequently panic-sell or chase trends, automation can be a performance advantage.

When a robo-advisor may NOT be ideal

You may prefer DIY (or human advice) if:

- You want advanced strategies (options, factor tilts, direct indexing)

- You need highly customized tax planning

- You have complex financial goals or business income

- You prefer full control over holdings and timing

A simple mental model

Think of a robo-advisor as an autopilot for diversified investing:

- Not the fastest for every scenario

- But extremely good at avoiding the most common mistakes