Robo-Advisor vs. Human Advisor vs. DIY: Which Investing Approach Fits You Best?

Should you automate, hire a professional, or invest on your own? Compare costs, control, customization, and real-world pros/cons so you can choose the right path confidently.

Investing7 min read

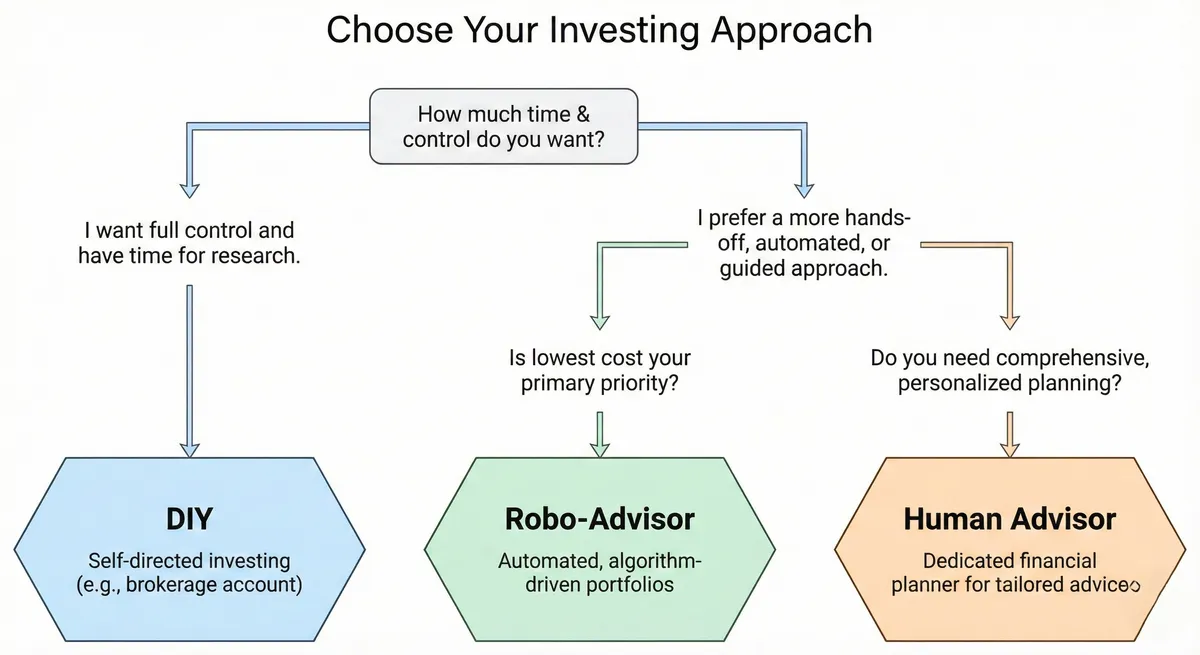

There are three common ways to invest:

- DIY investing (you choose and manage everything)

- Robo-advisor (automation + diversified portfolio)

- Human advisor (personal guidance and planning)

The right choice depends less on “which is best” and more on your behavior, complexity, and needs.

Option 1: DIY (do it yourself)

Best for:

- People who enjoy learning and want maximum control

- Investors who can stay disciplined during volatility

- Those who want customized allocations or strategies

Pros:

- Potentially lowest direct costs

- Full control over holdings and timing

- Flexible strategy choices

Cons:

- Easy to make emotional mistakes

- More time and decision fatigue

- Rebalancing and tax tracking require effort

Option 2: Robo-advisor

Best for:

- Busy investors who want automation

- People who want diversification without decisions

- Investors who struggle with consistency

Pros:

- Automatic rebalancing and discipline

- Simple goal-based approach

- Often low cost compared to full-service advising

Cons:

- Less customization than DIY or human advice

- Some platforms hold cash (possible cash drag)

- Advanced planning may be limited

Option 3: Human advisor

Best for:

- Complex situations (business owners, high net worth, taxes)

- Major life transitions (retirement, inheritance, divorce)

- People who want ongoing planning and accountability

Pros:

- Personalized strategy and planning

- Help with taxes, estate planning, and risk management

- Behavioral coaching during tough markets

Cons:

- Higher cost

- Quality varies significantly

- Some advisors may push products or unnecessary complexity

A simple decision framework

Pick based on complexity + behavior:

- Low complexity + high discipline: DIY can be great

- Low complexity + low discipline: robo-advisor is often ideal

- High complexity: consider a human advisor (or robo + one-time planning)

A powerful hybrid strategy

Many people use a hybrid setup:

- Robo-advisor for long-term investing

- DIY for a small “learning” portion (optional)

- One-time consultation with a professional for planning

That balances simplicity with confidence.