Robo-Advisor Fees, Tax-Loss Harvesting, and the True Cost of “Hands-Off” Investing

Robo-advisors can be low-cost, but not always. Learn how to compare advisory fees, ETF expenses, cash drag, and when tax-loss harvesting can actually move the needle.

A robo-advisor can be one of the simplest ways to invest—but “simple” doesn’t automatically mean “cheapest.” To compare platforms correctly, you need to understand the full cost stack and the features that may offset costs.

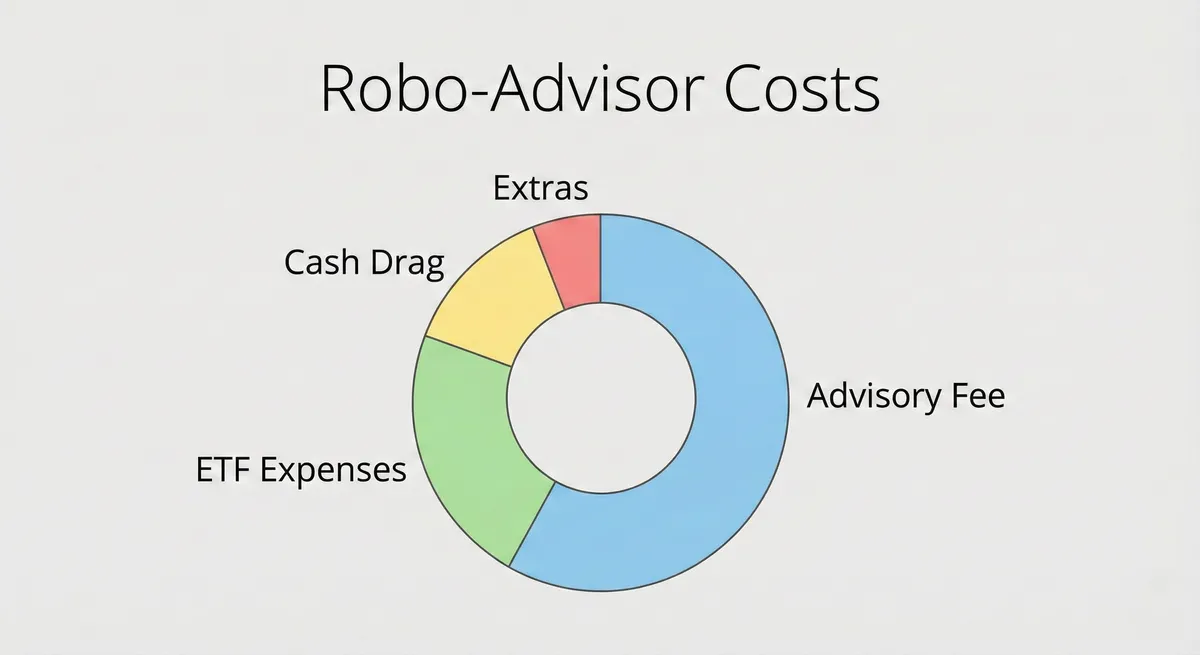

The full cost stack (what matters most)

1) Advisory fee

This is the platform fee, usually expressed annually as a percentage of assets.

2) ETF expense ratios

Even if the robo fee is low, the funds it uses can add ongoing costs.

3) Cash drag (the sneaky one)

Some platforms keep a portion of your money in cash as part of their model. If cash earns less than your target portfolio over time, that can reduce long-term returns.

4) Extra service tiers

Some robos charge more for:

- access to a human advisor

- advanced tax strategies

- higher-touch planning

Tax-loss harvesting (TLH): what it is and when it helps

Tax-loss harvesting means selling an investment at a loss to offset taxable gains, then reinvesting to maintain market exposure.

It tends to help most when:

- You invest in a taxable brokerage account (not IRA/401k)

- You have meaningful gains elsewhere to offset

- Your portfolio is large enough for losses to matter

- You’re in a higher tax bracket

It matters less when:

- You invest mostly in tax-advantaged accounts

- Your portfolio is small and long-term

- You rarely realize taxable gains

How to compare robo-advisors quickly

Use this checklist:

- Total annual cost: advisory fee + typical ETF expense ratio

- Cash allocation: does the platform hold cash by default?

- Tax tools: TLH availability and any minimums

- Account types: IRA, Roth IRA, taxable, joint, custodial

- Automation: rebalancing, recurring deposits, goal tracking

- Human support: optional or included? cost?

The key takeaway

A robo-advisor’s value is not just “automation.” It’s a package:

- diversification

- discipline

- rebalancing

- tax features (sometimes)

- reduced behavioral mistakes

The best choice is the platform that delivers those benefits at a cost that makes sense for your situation.