Renters Insurance Claims: How to Build a Home Inventory and Get Paid Faster

Most renters lose money on claims because they can’t prove what they owned. Learn how to create a simple home inventory, document losses, and avoid the claim mistakes that delay payouts.

If you ever file a renters insurance claim, your payout often depends on one thing: documentation. After a theft or fire, insurers will ask what was lost, how much it was worth, and whether you can prove ownership. The renters who get paid smoothly are the renters who prepared a simple inventory ahead of time.

Why Renters Underestimate Their Belongings

Your apartment may feel “minimal,” but replacement costs add up fast: laptop, phone, headphones, TV, couch, mattress, clothes, kitchen gear—suddenly you’re in five figures. A basic inventory is the easiest way to protect yourself from underpayment.

Step-by-Step: Create a Renters Home Inventory in 30 Minutes

Step 1: Do a Video Walkthrough

Walk room-by-room with your phone camera: open closets, drawers, cabinets. Narrate the brand and model of major items. This single video can be powerful claim support.

Step 2: List High-Value Items Separately

Create a short list of expensive items: laptop, camera gear, jewelry, collectibles, bikes, musical instruments. Save photos of receipts or screenshots of online order history if available.

Step 3: Store It Off-Device

If your phone is stolen or damaged, you still want access. Save your inventory to cloud storage or email it to yourself.

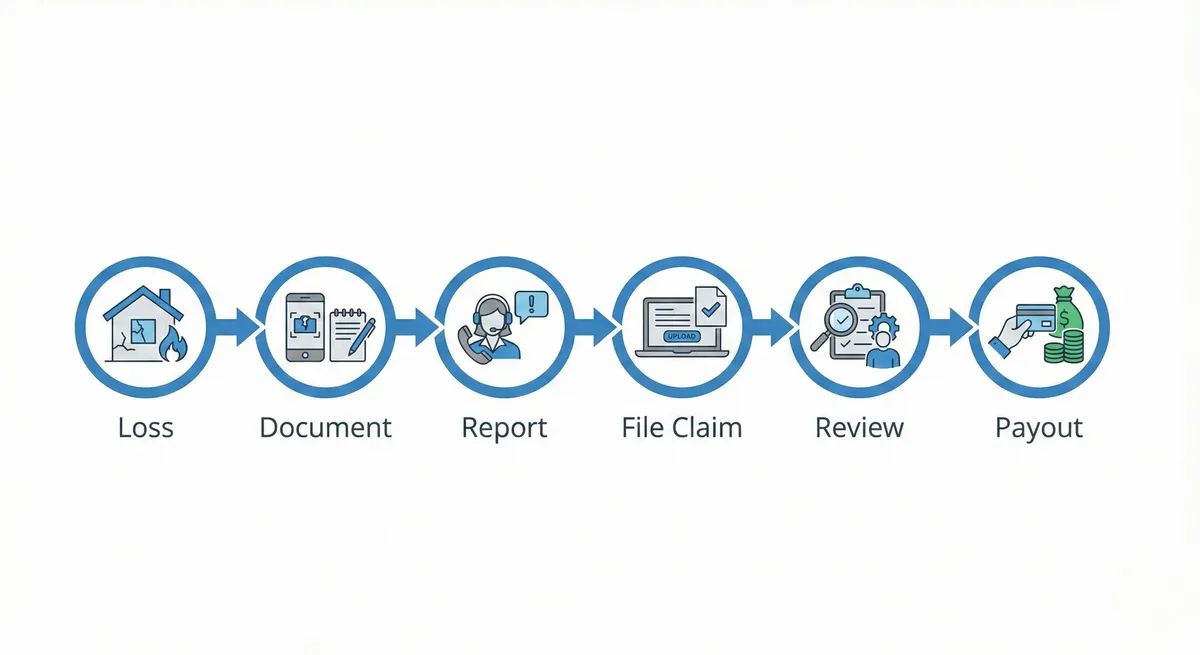

How Renters Claims Usually Work

1) Immediate Steps After a Loss

- Ensure safety and call emergency services if needed.

- File a police report for theft/vandalism if applicable.

- Take photos of damage and entry points.

2) File the Claim

Provide a clear description: what happened, when, and what was damaged or stolen. Ask for the claim number and what documentation the insurer needs.

3) Settlement Type Matters

If your policy is replacement cost, you may receive an initial ACV payout first, then receive the remaining amount after you replace the items and submit receipts.

Common Claim Mistakes (and How to Avoid Them)

- Throwing items away too early: Photograph first, keep proof.

- Generic descriptions: “TV” is weaker than “55-inch 4K LED TV, Model X.”

- Missing category limits: Jewelry caps can reduce payout unless scheduled.

- Delays in documentation: The longer you wait, the harder it is to reconstruct inventory.

Quick Checklist

- Create a video walkthrough inventory.

- Save receipts/screenshots for big purchases.

- Store inventory in cloud or email.

- Know whether your policy is ACV or replacement cost.