How Much Is Renters Insurance? Cost Drivers, Discounts, and How to Get the Best Policy

Renters insurance can be surprisingly cheap, but pricing varies by ZIP code and coverage choices. Learn what increases cost, what discounts actually work, and how to compare quotes correctly.

Renters insurance is often affordable, but the price you see depends on risk signals: where you live, how much coverage you buy, your deductible, and even whether your building has security features. This guide explains the key cost drivers and how to lower your premium without weakening protection.

What Impacts the Cost of Renters Insurance?

1) Location (ZIP Code Risk)

Insurers price risk based on local claim frequency: theft rates, fire risk, storm patterns, and the cost to temporarily house people after a loss. Two identical apartments can have very different premiums if they’re in different neighborhoods.

2) Personal Property Limit

Higher limits generally increase premium, but renters insurance is usually priced efficiently. The goal is to choose a limit that reflects your real replacement needs—not the lowest number just to satisfy a lease requirement.

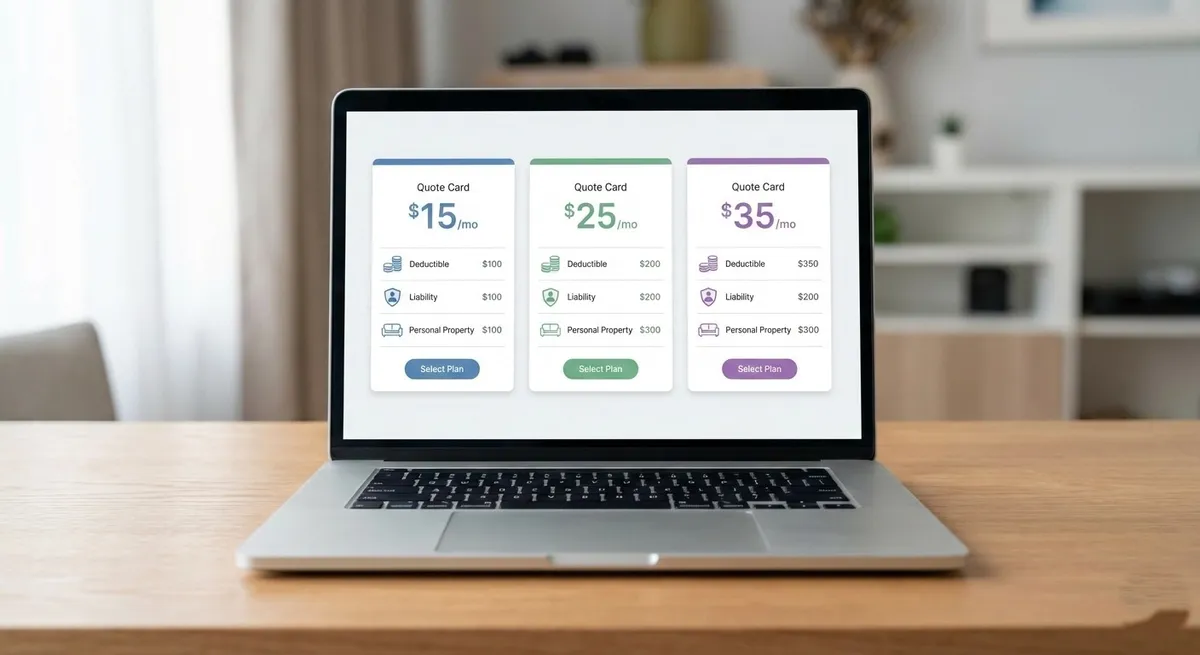

3) Deductible

A $250 deductible often costs more than a $500 or $1,000 deductible. Raising the deductible can lower premium, but only do it if you can comfortably pay it in a claim.

4) Claims History

Frequent claims can raise your premium and make it harder to switch insurers. In general, it’s smart to reserve claims for meaningful losses that you wouldn’t want to pay out of pocket.

Discounts That Actually Work

- Bundling: Combine renters + auto with the same insurer (often a strong discount).

- Security devices: Deadbolts, alarms, cameras, controlled building access.

- Claims-free discounts: Reward for clean history.

- Paid-in-full: Some insurers discount if you pay annually.

- Paperless / auto-pay: Small, but stacks.

How to Compare Policies Like a Pro

Step 1: Confirm Replacement Cost vs. ACV

Replacement cost coverage is typically better. ACV looks cheaper but can pay far less for older items.

Step 2: Check Category Limits

If you own jewelry, cameras, or collectibles, category caps matter. If the default cap is too low, schedule those items.

Step 3: Review Liability and Loss of Use

Liability is what protects your financial future. Loss-of-use matters if you’d struggle to pay for a hotel and food for weeks after a fire.

How Much Coverage Is “Enough” for Most Renters?

- Personal property: Often $20,000–$50,000 depending on lifestyle.

- Liability: Commonly $100,000–$300,000+.

- Deductible: Often $500–$1,000 if you have an emergency fund.

Quick Checklist to Lower Your Premium

- Bundle renters with auto if you drive.

- Raise deductible only if you can pay it today.

- Use security features and ask for credits.

- Shop at renewal with identical coverage settings.