The Hidden Costs of Refinancing: Appraisal, Title, and Fees

Refinancing isn't free. From appraisals to title insurance, we break down the typical closing costs involved and explain the pros and cons of 'no-closing-cost' loans.

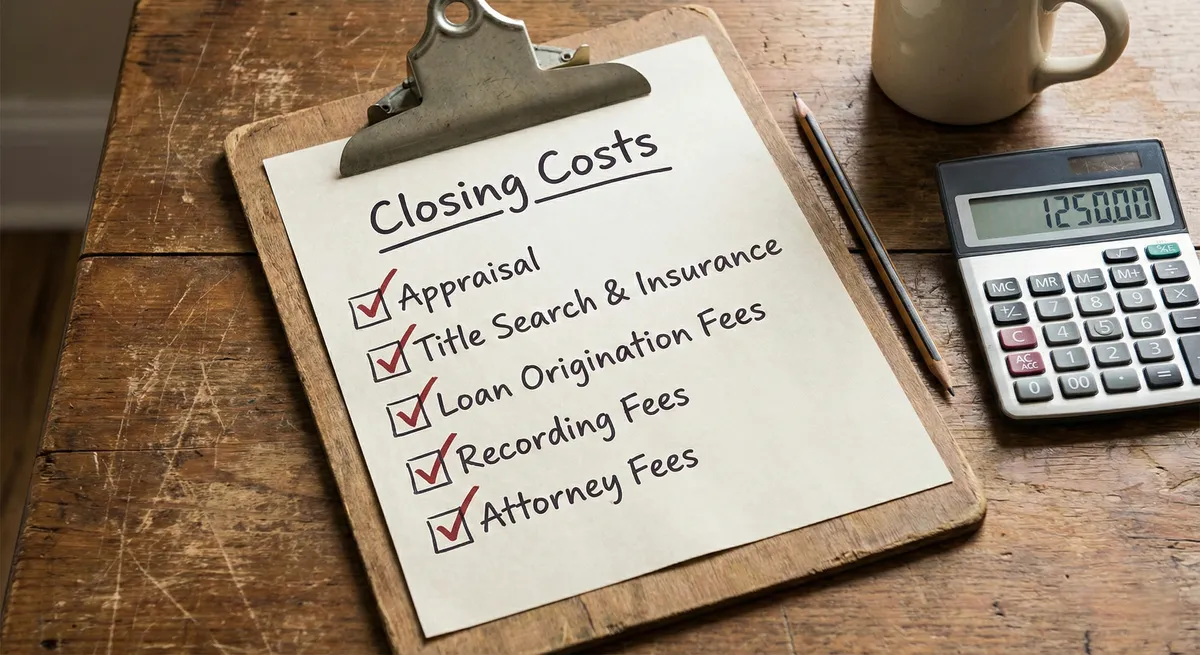

A lower interest rate is attractive, but the "price of admission" to get that rate is closing costs. Just like when you bought your home, refinancing requires a legal and financial process that costs money—typically 2% to 6% of the loan amount.

Breakdown of Typical Fees

Origination Fee:

The lender's fee for processing the loan (usually 0.5% to 1.5% of the loan amount).

Appraisal Fee ($300-$600):

The lender needs to verify your home's current market value to ensure they aren't lending more than the home is worth.

Title Search and Insurance:

Ensures there are no new liens on the property since you bought it.

Recording Fees:

Paid to your local county government to update public records.

The "No-Closing-Cost" Refinance Myth

You will often see ads for "No-Closing-Cost" refinancing. Nothing is truly free. In these scenarios, the lender typically does one of two things: Option A: They roll the closing costs into your loan balance (so you pay interest on them for 30 years). Option B: They charge a slightly higher interest rate to cover the costs on their end (Lender Credits). This isn't necessarily a scam—it can be a good strategy if you don't have cash on hand—but you must understand that you are still paying for it in the long run.

Prepaids and Escrow

Don't forget that you may need to pre-pay interest for the remainder of the month and fund a new escrow account for property taxes and insurance. While you will eventually get a refund check from your old escrow account, you need the cash upfront to start the new one.