Predicting the Next Fed Move: The Indicators That Signal Rate Cuts or Hikes

Want to anticipate rate cuts or hikes? Learn the indicators professionals watch—CPI, jobs, the yield curve, and market expectations—and how to translate them into smarter decisions for CDs and cash.

You can’t reliably forecast the exact next Fed decision — but you can understand the same indicators markets track. That’s valuable if you’re optimizing cash returns (HYSA/MMAs) or deciding when to lock rates with CDs.

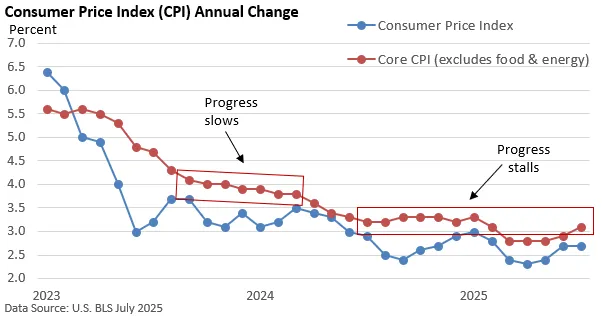

Indicator #1: Inflation (CPI and “Core” Measures)

Inflation is the clearest driver of restrictive vs. supportive policy. Watch:

- Headline CPI (overall price changes)

- Core CPI (removes volatile categories to show underlying trend)

- Trend (3–6 month annualized pace, not just one month)

- Surprises (actual vs. forecast — markets react to misses)

Indicator #2: The Labor Market (Jobs, Unemployment, Wages)

The Fed watches employment because labor strength supports spending. Key signals:

- Payroll growth (how fast jobs are being added)

- Unemployment (tight vs. cooling labor)

- Wage growth (can feed inflation if persistent)

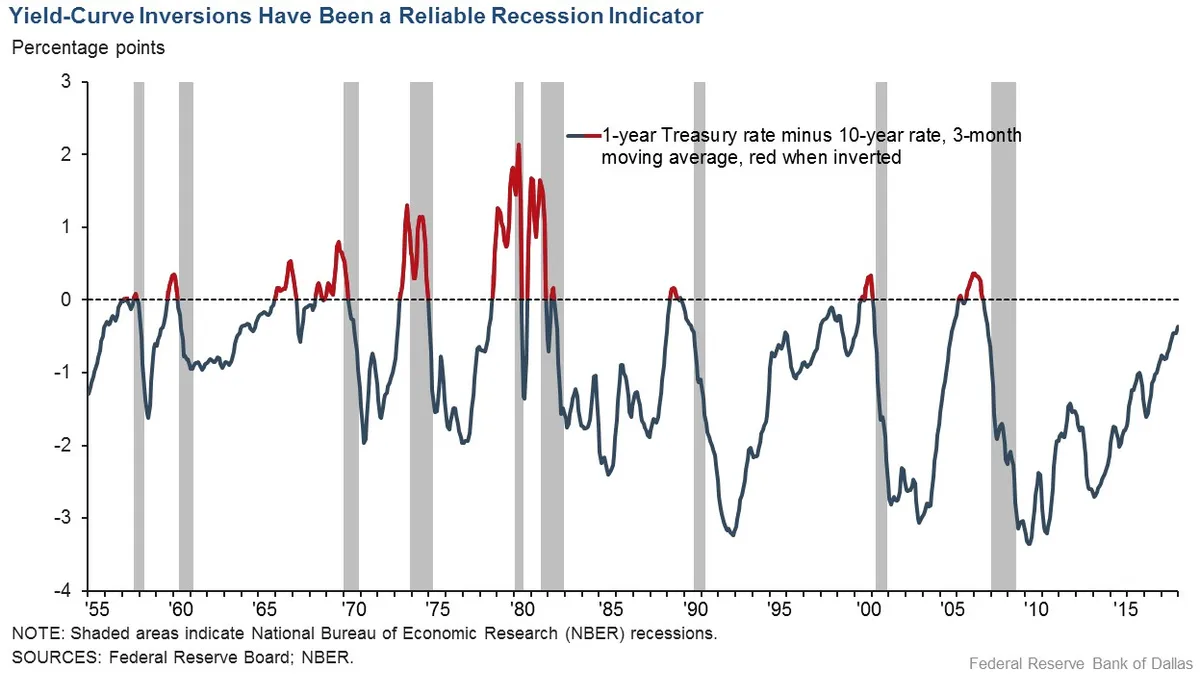

Indicator #3: The Yield Curve (Normal vs. Inverted)

The yield curve compares short-term and long-term rates. Inversions can reflect a market belief that rates will be lower in the future. It’s not a perfect crystal ball — but it’s one of the most watched macro signals.

Indicator #4: Market Expectations (What’s Priced In)

Markets move before the Fed does. That’s why you’ll often see:

- Bond yields shift ahead of meetings.

- Mortgage rates move even when the Fed holds steady.

- Deposit APYs lag because banks adjust strategically and operationally.

Translate Signals into Better Decisions

HYSA vs. CD

- If you expect cuts: locking with CDs can make sense for planned cash you won’t touch soon.

- If you expect hikes: keep more cash flexible; prefer short-term terms or competitive savings.

Money Market Accounts as a Middle Ground

If you want more access than a CD but a better return than traditional checking, MMAs can be a strong tool. See options on money market accounts.

Borrowers: Variable vs. Fixed Matters Most

Variable-rate borrowing tends to react faster to policy changes; fixed-rate pricing depends more on longer-term expectations. Knowing which you have helps you anticipate how quickly your payment might change.

Bottom Line

Rate watching doesn’t require complex models. Track inflation, jobs, the yield curve, and expectations — then match your tools (HYSA, MMA, CDs) to your time horizon. That’s how smart savers turn macro signals into better returns.