Online Broker Fees Explained: The Hidden Costs Behind “Commission-Free” Trading

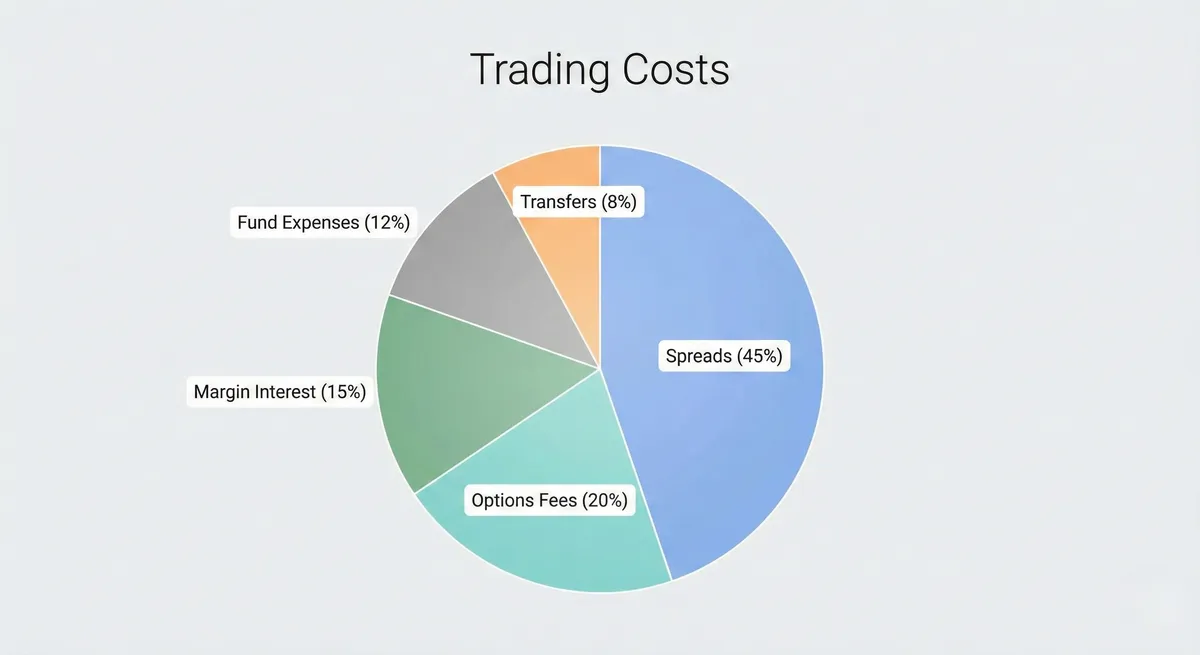

Commissions are only one part of the cost. Learn the real fee layers—spreads, options contract fees, margin interest, transfer fees, and fund expenses—so you keep more of your returns.

"$0 commissions" sounds like trading is free. In reality, investing costs come from multiple layers—and most of them are invisible unless you know where to look.

This guide breaks down the real cost map.

Cost Layer 1: Fees you can see

Options contract fees

Even small contract fees add up if you trade options frequently.

Margin interest

Borrowing to invest can amplify gains, but margin interest can also overwhelm returns—especially in higher-rate environments.

Account service fees

Less common now, but still possible:

- Outgoing wire fees

- Broker-assisted trade fees

- Paper statement fees

- Account transfer (ACATS) fees

Cost Layer 2: Spreads (the cost you don't see)

The bid-ask spread is the gap between the buy and sell price.

- Liquid ETFs often have tight spreads.

- Thinly traded stocks can have wide spreads.

- After-hours spreads can widen dramatically.

Even with $0 commission, spreads can make trading expensive.

Cost Layer 3: Execution quality and slippage

A broker's routing can impact whether you get a better or worse fill.

- Price improvement reduces costs.

- Slippage increases costs.

If you trade frequently, execution can be one of the biggest "fees" you never see on a statement.

Cost Layer 4: Fund expenses (long-term drag)

If you invest mainly through ETFs and mutual funds, your largest cost may be the expense ratio.

- A small difference (like 0.20% vs 0.03%) compounds over years.

Rule of thumb: for broad index exposure, prefer lower expense ratios unless the strategy truly adds value.

Cost Layer 5: Taxes (often the biggest cost for active traders)

This isn't a broker fee, but it matters:

- Frequent selling can trigger short-term capital gains.

- Tax inefficiency can erase the benefit of "smart" trades.

Investors who trade less often frequently keep more of what they earn.

How to compare brokers in 5 minutes

Use a simple checklist:

- Options pricing (if you trade options)

- Margin rates (if you use margin)

- Transfer fees (if you might switch later)

- Execution quality disclosures (where available)

- Tools that help you stay disciplined (automation, tax lots)