The True Cost of a Mortgage: Interest, APR, Points, and Closing Costs

What is a "discount point" and is it worth buying? We decode the jargon of mortgage quotes, explaining the crucial difference between Interest Rate and APR, and how to do the math on closing costs.

Mortgage quotes can feel like comparing apples to oranges. One lender offers 6.5% with no points, another offers 6.25% with 1 point—which is actually cheaper? Understanding the relationship between interest rate, APR, points, and closing costs is essential to making the right choice.

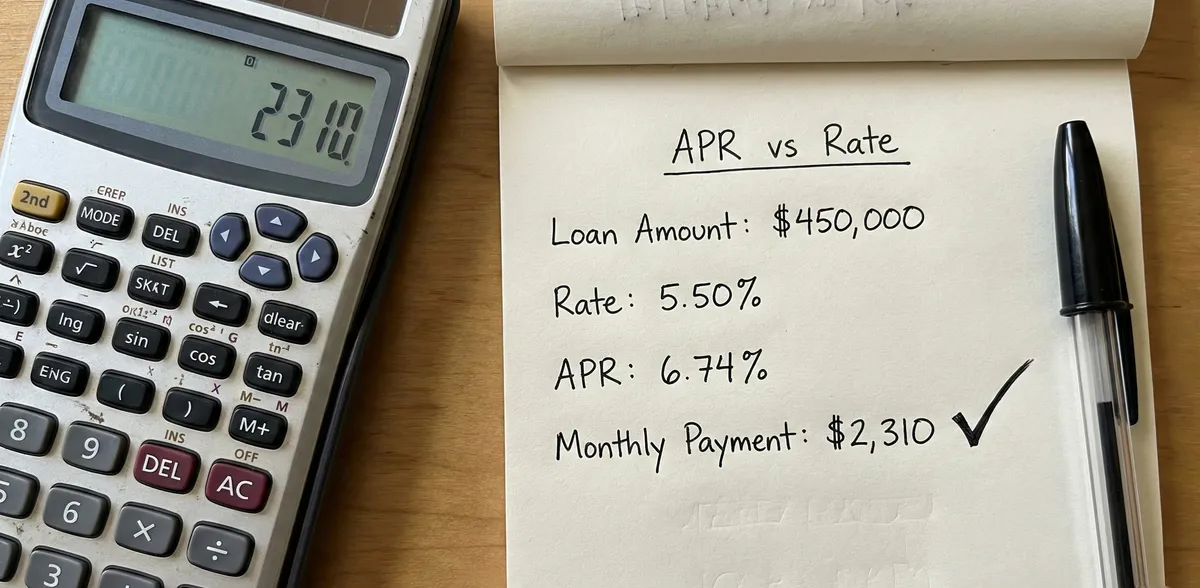

Interest Rate vs. APR

These two numbers are related but measure different things:

- Interest Rate: The annual cost of borrowing the principal, expressed as a percentage. This determines your monthly payment.

- APR (Annual Percentage Rate): The total cost of the loan including interest AND fees, expressed as a yearly rate. This is your "all-in" cost.

Under the Truth in Lending Act (TILA), lenders must disclose the APR alongside the interest rate. The APR is always higher than the interest rate because it includes:

- Origination fees

- Discount points

- Mortgage broker fees

- Some closing costs

Example: Comparing Two Lenders

| Lender A | Lender B | |

|---|---|---|

| Interest Rate | 6.500% | 6.375% |

| APR | 6.650% | 6.750% |

| Upfront Fees | $2,500 | $5,800 |

Key Insight: Lender B has a lower interest rate but a higher APR. This means their fees are significantly higher. If you're staying in the home long-term, Lender B might win. If you're selling or refinancing within 5 years, Lender A is likely cheaper overall.

Discount Points: Buying Down Your Rate

A discount point is prepaid interest. Each point costs 1% of your loan amount and typically reduces your interest rate by 0.25% (though this varies by lender and market conditions).

Example: $400,000 Loan

- 0 Points: 6.5% rate = $2,528/month

- 1 Point ($4,000): 6.25% rate = $2,462/month

- Monthly Savings: $66

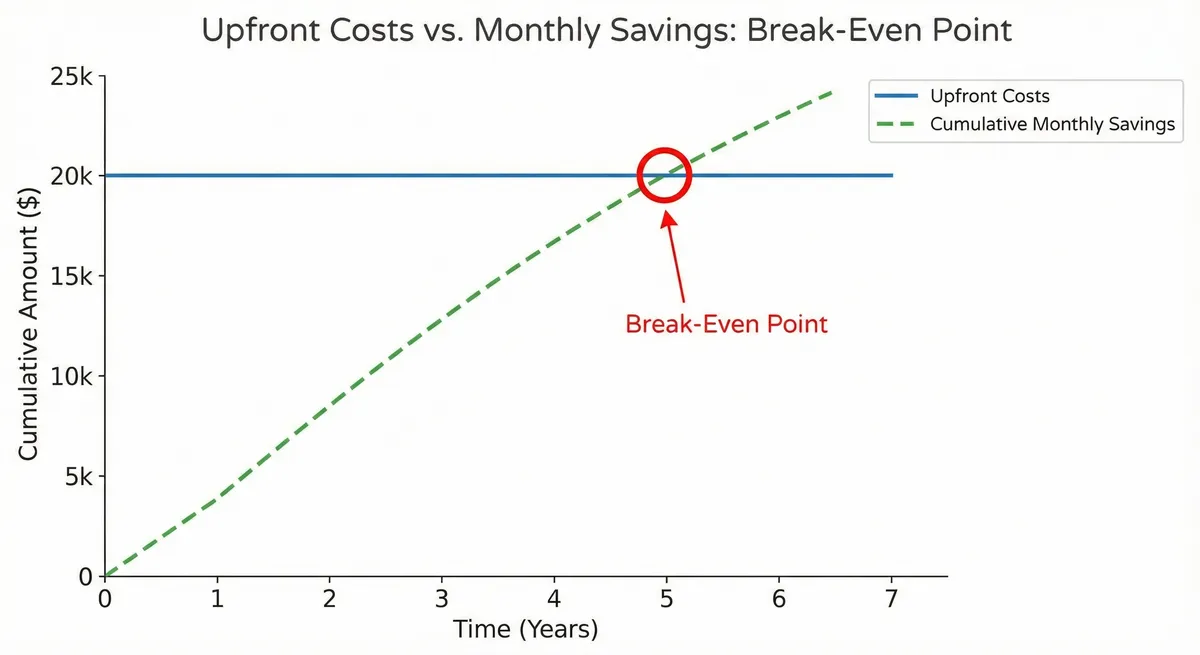

The Break-Even Math

To determine if points are worth it, calculate your break-even period:

Break-Even = Upfront Cost ÷ Monthly Savings

$4,000 ÷ $66 = 60.6 months (about 5 years)

| Upfront Points Cost | Monthly Savings | Break-Even Period |

|---|---|---|

| $4,000 (1 point) | $66 | 5 years |

| $8,000 (2 points) | $130 | 5.1 years |

| $2,000 (0.5 points) | $33 | 5 years |

Rule of Thumb: Only buy points if you plan to stay in the home longer than the break-even period. If you might move or refinance within 5 years, skip the points.

Closing Costs Breakdown

Closing costs typically range from 2% to 5% of the loan amount. They fall into three main categories:

1. Lender Fees

- Origination fee (0.5% - 1% of loan)

- Underwriting fee ($300 - $900)

- Application fee ($0 - $500)

- Discount points (optional)

2. Third-Party Fees

- Appraisal ($400 - $700)

- Title insurance ($1,000 - $4,000)

- Title search ($200 - $400)

- Survey ($300 - $500)

- Credit report ($30 - $50)

- Attorney fees (varies by state)

3. Prepaids & Escrow

- Prepaid interest (daily interest from closing to first payment)

- Property taxes (2-6 months in escrow)

- Homeowners insurance (12 months prepaid)

- Mortgage insurance (if applicable)

Understanding Your Loan Estimate

Under the TRID (TILA-RESPA Integrated Disclosure) rule, lenders must provide a standardized Loan Estimate within 3 business days of your application.

📋 How to Read Your Loan Estimate

- ✓ Page 1: Loan terms, projected payments, closing costs at a glance

- ✓ Page 2: Itemized closing costs—Loan Costs (Section A, B, C) vs. Other Costs (Section E, F, G, H)

- ✓ Page 3: Cash to close calculation, comparisons, and important warnings

- ✓ Look for "Can this amount increase?" column—some fees are capped, others aren't

- ✓ Compare the APR across Loan Estimates from different lenders

Shopping Strategy: Get the Best Deal

To ensure you're getting the best mortgage deal:

- Shop 3+ lenders on the same day. Rates change daily, so same-day quotes are essential for accurate comparison.

- Compare APR, not just interest rate. The APR accounts for fees and gives you the true cost.

- Negotiate. Lenders have room to reduce origination fees, waive application fees, or adjust pricing. Ask: "Can you match this competitor's APR?"

- Don't forget credit unions. They often have lower rates and fees than big banks.

- Lock your rate at the right time. Once you have an accepted offer, lock your rate to protect against increases during the closing period.

Savings Tip: Multiple mortgage inquiries within 45 days count as a single hard pull on your credit. Shop aggressively without fear of hurting your score.

Educational purposes only. Not financial advice.