MMA vs. High-Yield Savings vs. Checking: Where Should Your Cash Go?

Choosing the right place to park your cash can earn you hundreds of dollars in extra interest. We compare Money Market Accounts against HYSAs and Checking accounts to help you decide.

With so many banking products available, "analysis paralysis" is common. Should you prioritize the highest possible APY, or the ability to swipe a debit card? This deep-dive comparison breaks down the pros, cons, and math of each account type.

Round 1: MMA vs. High-Yield Savings (HYSA)

The Interest Rate Battle

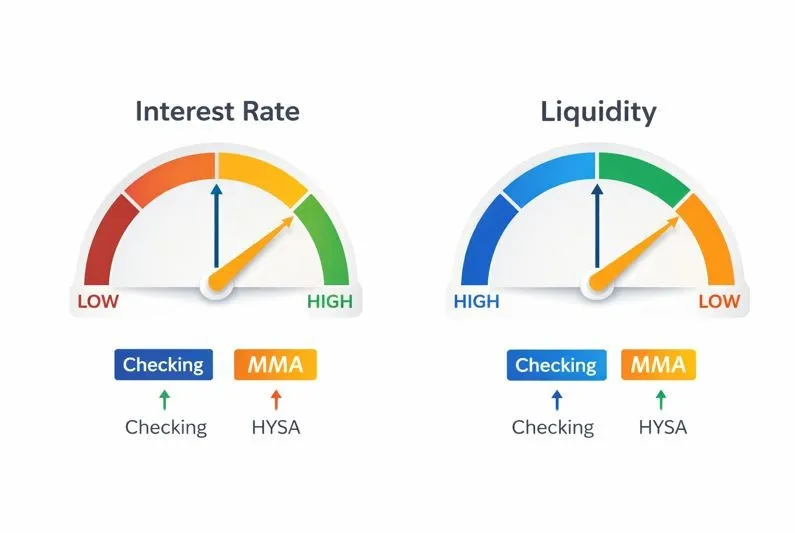

Historically, online HYSAs tend to offer slightly higher APYs than MMAs. If an online savings account pays 4.50%, a comparable MMA might pay 4.25%.

The Access Battle

HYSAs are "locked" behind transfers. To spend that money, you must transfer it to a checking account (1-3 days). MMAs allow you to bypass this step with checks or debit cards.

Verdict: If you strictly want to maximize profit and won't touch the money, choose a HYSA. If you need liquidity for unexpected expenses, the slightly lower rate of an MMA is worth the convenience.

Round 2: MMA vs. Traditional Checking

There is almost no competition here regarding returns. Traditional checking accounts pay an average of 0.07% APY. An MMA can pay 4.00%+.

The limitation: Transaction limits. You cannot use an MMA for daily coffee runs or grocery shopping because of federal transaction limits (historically Regulation D).

Verdict: Keep your monthly spending money in Checking. Move everything else—your "buffer" cash—to an MMA.

The "Tiered Rate" Factor

One unique feature of Money Market Accounts is "Tiered Interest."

Example structure:

- Balance $0 - $9,999: Earns 0.50% APY

- Balance $10,000 - $24,999: Earns 2.50% APY

- Balance $25,000+: Earns 4.50% APY

Unlike HYSAs, which often give everyone the same rate, MMAs reward higher net worth depositors. Always read the rate sheet carefully to ensure you qualify for the advertised "Jumbo" rate.

Scenario: The Perfect Banking Setup

For many financial experts, the "Trifecta" is the best approach:

- Checking: For monthly bills and daily spending (1 month of expenses).

- MMA: For your Emergency Fund and short-term goals (3-6 months of expenses). Liquid but high growth.

- Investments: For long-term wealth (Stocks, Bonds).

Disclaimer: This guide is for educational purposes only and does not constitute financial advice.