The Fine Print of Money Market Accounts: Fees, Limits, and Protections

Before you open a Money Market Account, you need to understand the rules. From the '6-transaction limit' to minimum balance fees, we expose the fine print that banks often hide.

Money Market Accounts are powerful tools, but they come with strings attached. Banks offer these high rates and check-writing privileges with the expectation that you will maintain a large balance and not treat the account like a daily ATM. Here is what you need to watch out for.

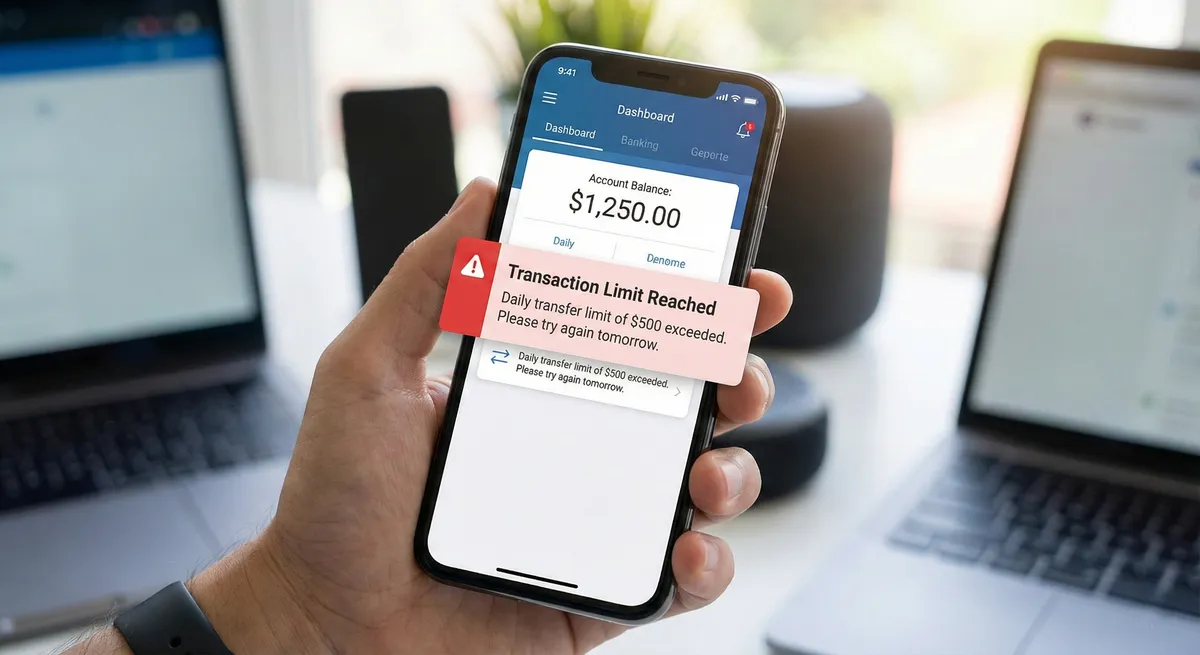

The "Regulation D" Legacy (Transaction Limits)

For years, Federal Reserve Regulation D limited savings and MMA withdrawals to 6 per month. While the Fed suspended the mandatory enforcement of this rule in 2020, many banks have kept it in their own internal policies.

The Trap

If you exceed 6 convenient transactions (checks, debit swipes, online transfers) in a month, the bank may charge an "Excessive Withdrawal Fee" (often $10-$25 per transaction).

The Consequence

If you repeatedly exceed the limit, the bank reserves the right to close your MMA or convert it into a standard, non-interest-bearing checking account.

Monthly Maintenance Fees

Because MMAs offer premium features, they are expensive for banks to maintain.

- Typical fee: $10 to $25 per month.

- How to waive it: Most banks waive this fee if you maintain a minimum daily balance (e.g., $2,500 or $5,000).

Warning: If your balance drops below this threshold for even one day in the cycle, you get hit with the fee, which can wipe out months of interest earnings.

Variable Rates Are Not Guaranteed

Like savings accounts, MMA rates are variable. If the Federal Reserve cuts interest rates, your MMA rate will drop, usually within one billing cycle. This is different from a Certificate of Deposit (CD), which locks in your rate. Do not open an MMA expecting the 5% rate to last forever.

FDIC Insurance Limits

MMAs are safe, but only up to a limit. The standard insurance covers $250,000 per depositor, per insured bank.

Strategy for high net worth: If you have $500,000 in cash, do not put it all in one MMA at one bank. Split it between two banks, or open a joint account (which covers up to $500,000 total) to ensure every dollar is government-protected.

Disclaimer: This guide is for educational purposes only and does not constitute financial advice.