The Magic of Compound Interest: How Money Makes Money

Albert Einstein reportedly called compound interest the 'eighth wonder of the world.' We break down the math behind exponential growth and why starting early matters more than how much you save.

Building wealth isn't just about how much you earn; it's about how hard your money works for you. The engine behind this growth is "Compound Interest." Unlike simple interest, where you only earn on your principal, compound interest means you earn interest on your interest.

The Mechanics of Compounding

Imagine you deposit $10,000 into an account with 5% APY.

- Year 1: You earn $500. Balance: $10,500.

- Year 2: You earn 5% on $10,500 (not just the original $10,000). You earn $525. Balance: $11,025.

- Year 3: You earn 5% on $11,025. You earn $551.25.

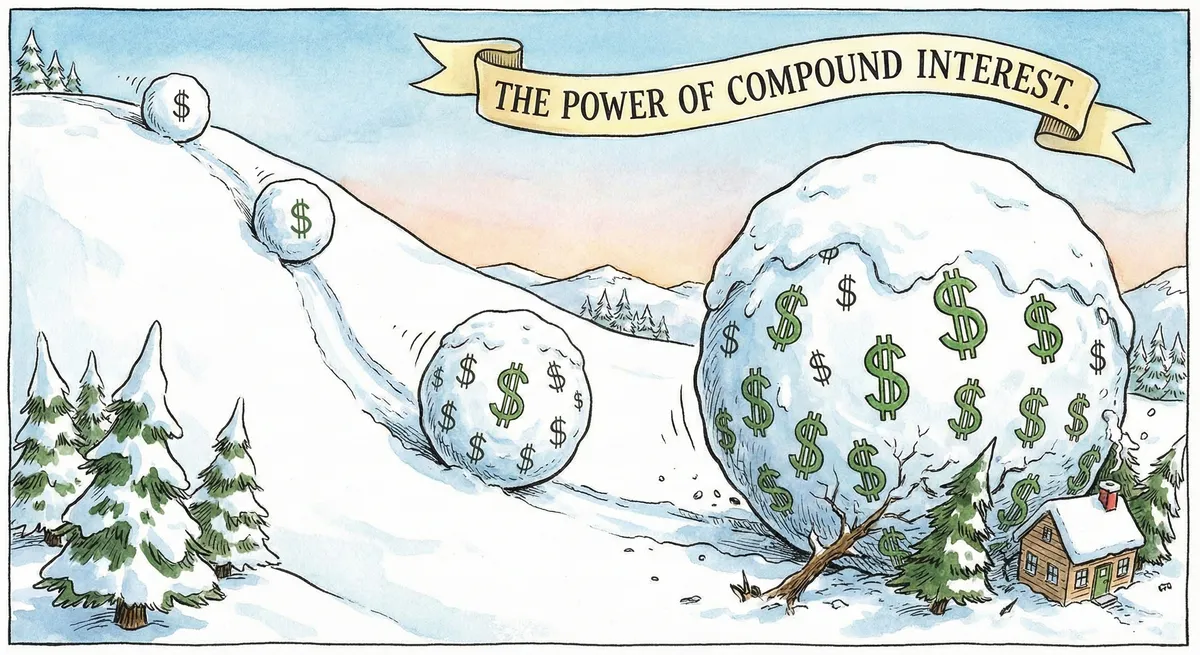

Over 30 years, that single $10,000 deposit grows to over $43,000 without you adding another penny. This is the "Snowball Effect."

The Frequency Factor

Banks can compound interest Daily, Monthly, Quarterly, or Annually. Daily Compounding is the gold standard. Even if the interest is paid out monthly, calculating it daily means your money grows slightly faster. Always check the bank's "Terms and Conditions" to see their compounding schedule.

The Rule of 72

This is a quick mental math hack to estimate how long it will take to double your money.

Formula: 72 / Interest Rate = Years to Double.

- Example: At a 4% interest rate, 72 / 4 = 18 years to double your money.

- Example: At a 0.01% interest rate (traditional bank), 72 / 0.01 = 7,200 years.

This stark contrast highlights why choosing the right savings account is non-negotiable.

Inflation: The Silent Killer

If your savings account pays 4% but inflation is 3%, your "Real Rate of Return" is only 1%. If inflation is higher than your interest rate, you are technically losing purchasing power. This is why keeping excess cash in a checking account (paying 0%) is a financial error. Your goal is to always beat, or at least match, the inflation rate.

Disclaimer: This guide is for educational purposes only and does not constitute financial advice.