Life Insurance Beneficiaries and Estate Planning: Avoid These Costly Mistakes

Naming the wrong beneficiary can send money into probate, delay payouts, or create family conflict. Learn how beneficiaries work, how to handle minors, and how to keep your plan legally clean.

Buying life insurance is only half the job. The other half is making sure the money goes where you intend—quickly, legally, and without confusion. Beneficiary errors are surprisingly common and can cause delays, disputes, or even send funds into probate.

How Life Insurance Payouts Usually Work

Life insurance benefits generally pay directly to the named beneficiaries, which often makes payouts faster than assets that must pass through probate. That speed is one reason life insurance is such a powerful planning tool.

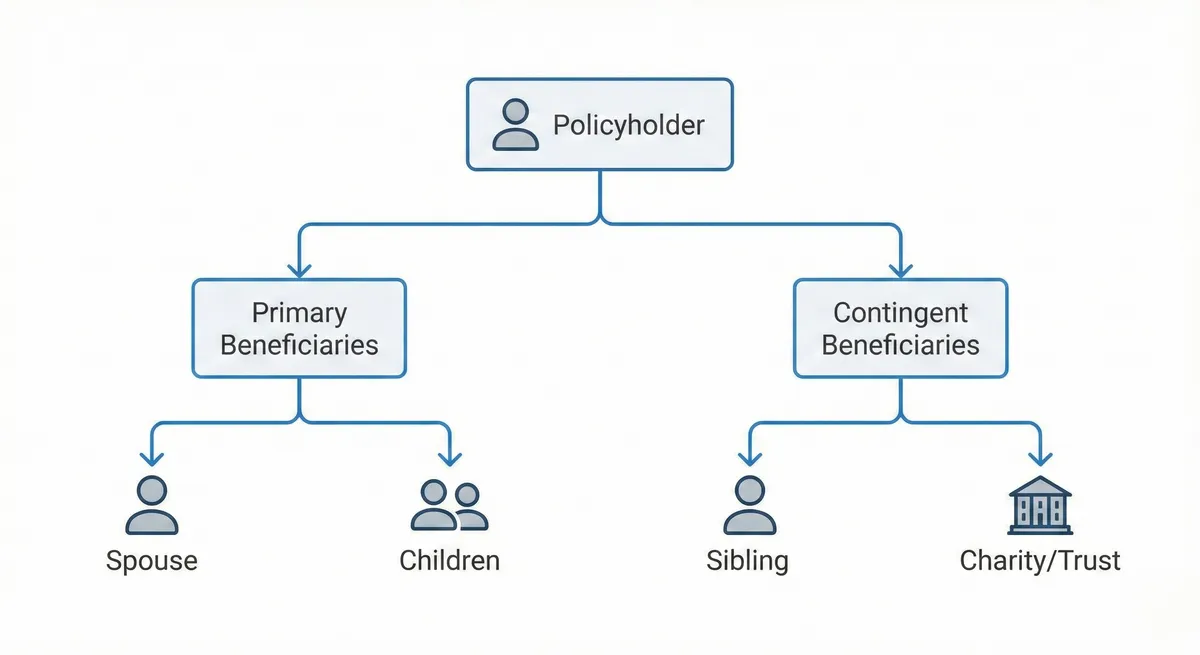

Primary vs. Contingent Beneficiaries

- Primary beneficiary: First in line to receive the payout.

- Contingent beneficiary: Backup beneficiary if the primary cannot receive the benefit.

Many mistakes happen when people name only a primary beneficiary and forget a contingent.

Common Beneficiary Mistakes (and Fixes)

1) Naming a Minor Child Directly

Minors often can’t legally receive large payouts without a court-supervised guardian arrangement. This can slow down access to funds and add legal complexity. A common solution is using a trust or naming an appropriate legal structure, depending on your plan.

2) Forgetting to Update After Life Changes

Marriage, divorce, new children, and deaths should trigger a beneficiary review. Outdated beneficiary designations are one of the biggest sources of disputes.

3) Not Specifying Percentages

If you have multiple beneficiaries, confirm the percentages add up and reflect your intent. “Equal split” is not always what you want when there are different responsibilities or needs.

4) Confusing “Per Stirpes” and “Per Capita”

These terms affect how benefits pass down if a beneficiary dies before you. The details vary by insurer and jurisdiction, but the key is: make sure your intent matches the designation language.

Does Life Insurance Go Through Probate?

Typically, if beneficiaries are properly named, life insurance pays outside probate. But if you name “my estate” as beneficiary (or you forget to name one), benefits may become part of the estate, potentially delaying access and increasing administrative complexity.

Planning for Blended Families

If you have children from a previous relationship, or complex family dynamics, beneficiary designations can become sensitive. Consider how funds will support your spouse and your children fairly—and document the plan clearly.

Quick Checklist

- Name both primary and contingent beneficiaries.

- Confirm whether minors require a trust/structure in your plan.

- Update beneficiaries after marriage/divorce/new children.

- Keep a copy of your policy and designations accessible.