Homeowners Insurance Explained: What It Covers (and What's Excluded)

Home insurance isn’t just “fire coverage.” Learn what dwelling, personal property, liability, and loss-of-use really pay for—plus the exclusions that surprise homeowners.

Homeowners insurance is one of the most misunderstood financial products in America. Many people assume “I’m insured” means “everything is covered,” but policies are built from specific coverage buckets and specific exclusions. This guide breaks down what a typical homeowners policy covers, what it usually excludes, and how to set limits that protect your home and savings.

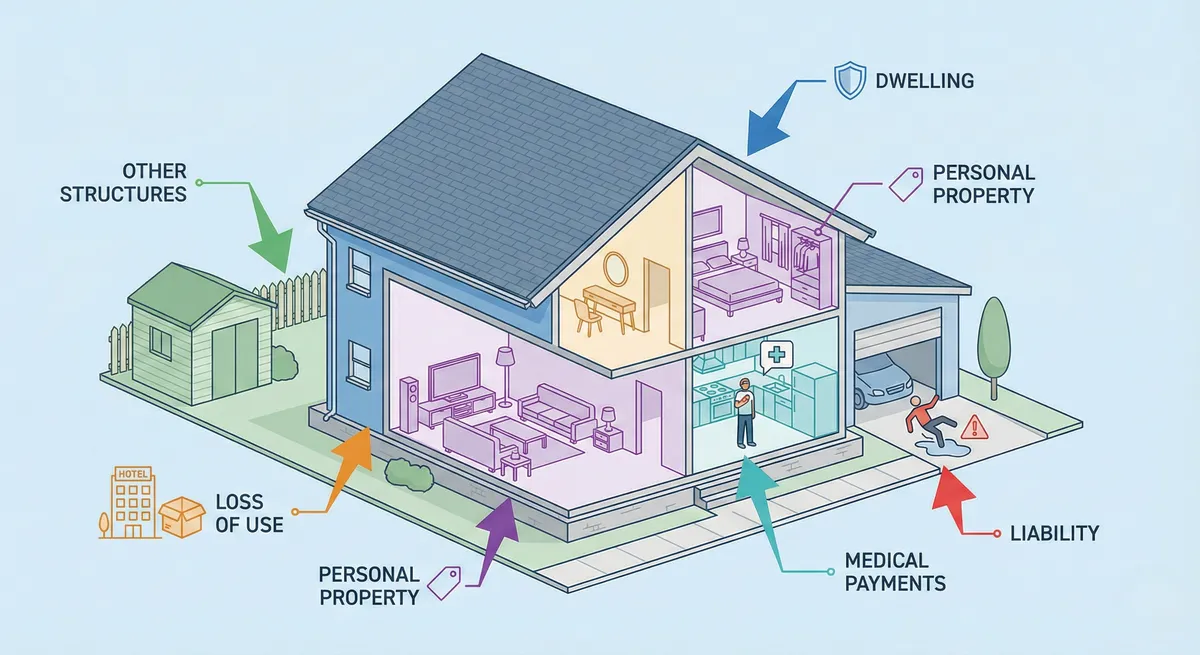

The 6 Core Parts of a Standard Homeowners Policy

Coverage A: Dwelling (the structure)

This pays to repair or rebuild the physical structure of your home after a covered loss: walls, roof, foundation, built-in cabinets, attached garage, and permanently installed systems. The most important concept here is replacement cost—the cost to rebuild today, not what you paid for the house.

Coverage B: Other Structures

Separate structures on your property (detached garage, shed, fence, guest house) can be covered here. Policies often set this as a percentage of dwelling coverage, but you can sometimes adjust it if you have a large detached structure.

Coverage C: Personal Property

Your belongings: furniture, electronics, clothes, appliances (not built-in), and more. Many policies have special limits for high-value categories like jewelry, watches, firearms, collectibles, and business equipment—meaning your overall limit might be high, but a category cap can reduce payout.

Coverage D: Loss of Use (Additional Living Expenses)

If a covered loss makes the home unlivable, loss-of-use can help pay for temporary housing, meals, and other necessary expenses above your normal living costs. This is one of the most valuable coverages during major disasters.

Coverage E: Personal Liability

Liability helps protect your assets if someone is injured on your property or if you accidentally cause damage to someone else. Think slip-and-fall claims, dog bites, or a tree limb damaging a neighbor’s car. Legal defense can be included, which is often the most expensive part of a lawsuit.

Coverage F: Medical Payments to Others

This is smaller, “no-fault” medical coverage that can help pay minor medical bills if a guest is hurt, potentially preventing a bigger liability claim.

Common Exclusions That Surprise Homeowners

The most common complaint in home insurance is “My claim got denied.” Often, the damage fell into a common excluded category:

- Flood: Rising water is typically excluded and requires separate flood insurance.

- Earthquake: Usually excluded; separate endorsement/policy may be needed.

- Wear and tear / maintenance: Old roof, gradual leaks, rot, mold from long-term moisture are often denied.

- Sewer backup: Often excluded unless you add a sewer/water backup endorsement.

- Termite/pest damage: Usually excluded as a maintenance issue.

Replacement Cost vs. Actual Cash Value

A big payout difference comes from how your policy values property:

- Replacement Cost: Pays to replace items with new equivalents (best option).

- Actual Cash Value (ACV): Depreciated value (often much lower).

How to Set Dwelling Coverage the Right Way

Do not set dwelling coverage based on your home’s market value. Market value includes land and neighborhood pricing. Insurance is about rebuild cost: labor, materials, and local construction costs. Use your insurer’s rebuild estimate tools and update coverage after major renovations.

Smart Add-Ons (Endorsements) Worth Considering

- Sewer/water backup: One of the most common real-world claims gaps.

- Scheduled personal property: Adds coverage for jewelry, art, collectibles beyond category limits.

- Extended replacement cost: Adds a cushion if rebuild costs spike after a disaster.

- Ordinance or law: Helps pay to rebuild to updated building codes.

Quick Checklist Before You Buy

- Does Coverage A reflect realistic rebuild costs (not market price)?

- Is personal property replacement cost included (not ACV)?

- Do you need sewer backup or scheduled property endorsements?

- Are liability limits high enough to protect savings and future income?