Federal Funds Rate Explained: What It Is, How the Fed Sets It, and Why It Moves Markets

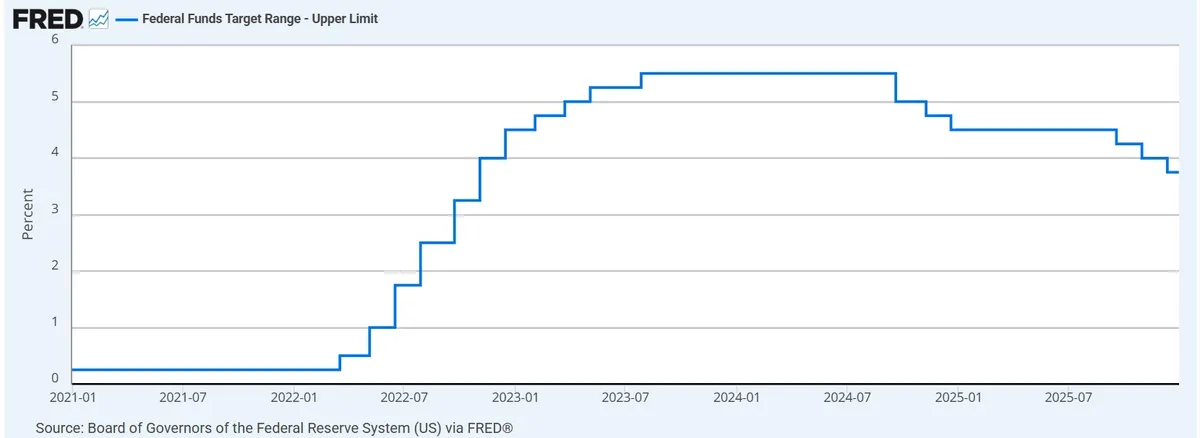

The Federal Funds Rate is one of the most important rates in the U.S. economy. Learn what it is, how the Fed targets it, and how it quietly influences everything from savings APY to mortgage rates.

If you’ve ever wondered why savings account APYs shift, why credit card APRs feel “sticky,” or why markets obsess over FOMC days, the answer often starts with one concept: the Federal Funds Rate.

The federal funds rate is the interest rate banks charge each other for overnight loans of reserve balances. Consumers don’t borrow at this rate directly — but it acts like a master dial for short-term U.S. interest rates. When the dial moves, the system re-prices.

Target Range vs. the “Effective” Rate

- Target Range: The policy range the Federal Reserve aims for.

- Effective Federal Funds Rate (EFFR): The actual market rate observed in overnight transactions, usually trading within (or very near) the target range.

How the Fed Guides the Rate (Without “Setting” It Like a Price Tag)

A common myth is that the Fed sets the federal funds rate the way a store sets a price. In reality, the Fed targets a range and uses implementation tools to steer overnight rates toward that range.

1) The FOMC: The Decision Engine

The Federal Open Market Committee (FOMC) meets on a schedule and votes on the target range. Markets react because the target influences borrowing costs across the economy.

2) The “Floor” Concept: Why Reserve Interest Matters

In modern monetary policy, a key anchor is the interest paid on certain reserve balances. If banks can earn an attractive, low-risk return by holding funds, they’re less willing to lend overnight below that level — helping keep the market rate aligned.

3) The Transmission Channel: From Overnight Money to Your Wallet

Once short-term funding costs move, lenders update pricing on products like high-yield savings accounts, money market accounts, CDs, and many variable-rate credit products.

Federal Funds Rate vs. Prime Rate vs. SOFR

You’ll see multiple “headline” rates in U.S. finance. Here’s the mental map:

- Federal Funds Rate: the Fed’s core policy target (the main dial).

- Prime Rate: a widely quoted bank lending reference; it tends to move after policy moves.

- SOFR: a major benchmark reflecting secured overnight borrowing; used in many contracts.

Why the Fed Raises or Cuts

The Fed’s motivation usually comes down to balancing these forces:

- Inflation pressures (rates may rise to cool demand).

- Economic slowdown risk (rates may fall to support activity).

- Financial stability (pace and communication can matter as much as direction).

FAQ

Can I get a loan at the federal funds rate?

No. It’s an interbank overnight rate. But many consumer rates move in the same direction over time.

Is this the “Fed rate” mentioned on the news?

Most headlines refer to the policy target range for the federal funds rate.

How fast do savings APYs respond?

It varies. Some online banks move quickly; others adjust slowly, especially when competition is low.

Bottom Line

If you track one macro rate, track this one. It influences the direction of short-term borrowing costs and the returns you can earn on cash. Understanding it gives you leverage — as a saver, borrower, and investor.