How Credit Card Rewards Actually Work: Points, Miles, Cash Back, and Value

1 point is not always 1 cent. Learn how cash back, points, miles, transfer partners, and redemption rules determine your real value—and how to pick a rewards setup you’ll actually use.

Rewards cards sound simple: spend money, get value back. In practice, rewards are a pricing system with rules, categories, and “best use” redemptions.

This guide helps you understand:

- Cash back vs points vs miles

- Why “3x points” can be better (or worse) than “3% cash back”

- How to estimate your real rewards value

The 3 main rewards types

1) Cash back (the simplest)

- You earn a percentage of spending (1%–5% common in categories)

- Value is straightforward: $1 = $1

Best for: most people who want simple, predictable value.

2) Points (flexible, can be high value)

- “Points” are a currency. Their value depends on redemption.

- They can be used for travel, gift cards, statement credits, or transferred to partners.

Best for: people who will actually use redemption sweet spots.

3) Miles (often just points with travel branding)

- Many “miles” programs behave like points

- Value ranges based on where/how you redeem

Best for: frequent travelers (or people who love optimizing flights/hotels).

The truth about “point value”

A common baseline:

- 1 point ≈ 1 cent when redeemed as a statement credit (often the floor)

- >1 cent can be possible with travel portals or partner transfers

- <1 cent happens with bad redemptions (some gift cards, certain portals)

Quick mental model

Think of points like:

- Cash back = fixed exchange rate

- Points/miles = variable exchange rate

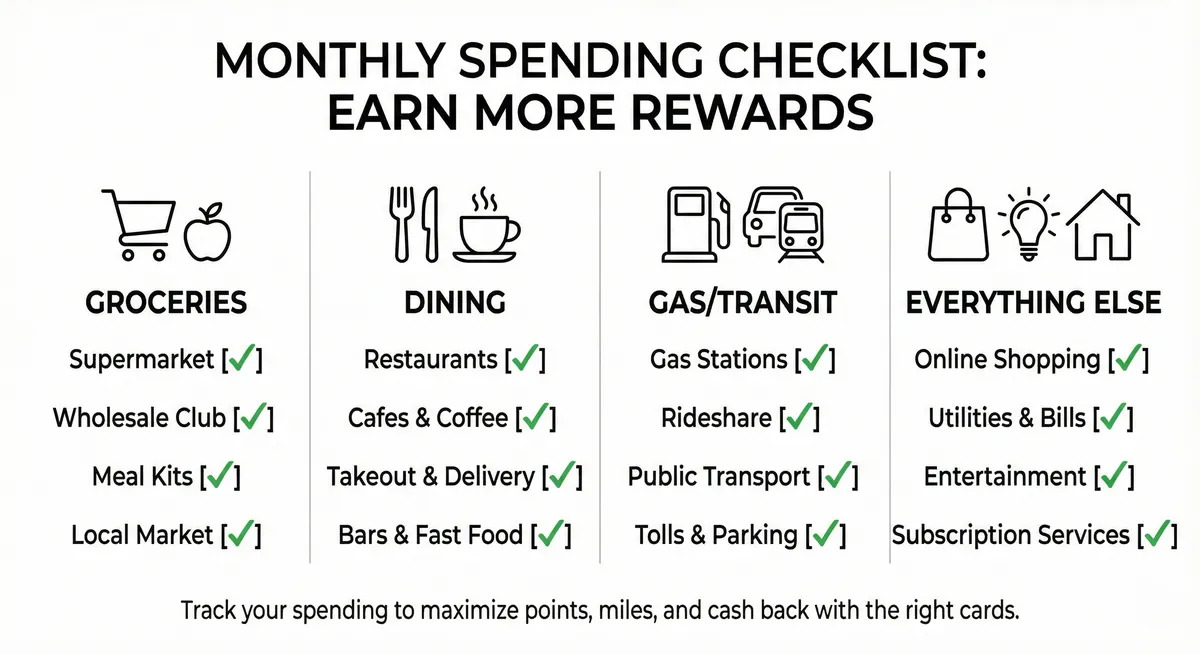

Categories: where rewards are won or lost

Most people don’t need 12 cards. You typically need coverage for:

- Groceries

- Gas / transit

- Dining

- Travel

- Everything else (catch-all)

The biggest mistake is picking a high “headline” offer you won’t use consistently.

A simple “real value” calculation you can use

Estimate yearly rewards:

- Write your monthly spend by category

- Multiply by reward rate

- Multiply by your realistic point value

Example (points card):

- Dining: $500/mo at 3x

- Points per year: $500 × 12 × 3 = 18,000 points

- If you redeem at 1 cent: value = $180/year

- If you redeem at 1.5 cents: value = $270/year

That difference is why some people love points—and why others should avoid them.

Sign-up bonuses: the real engine

For many rewards cards, the sign-up bonus can outweigh a year of normal spending rewards.

But it only counts as a win if:

- You can meet the spend requirement naturally

- You won’t carry a balance and pay interest

- The annual fee (if any) is justified

Transfer partners: when points get powerful

If a program allows transferring points to airlines/hotels, you may find redemptions that beat 1 cent/point.

But the trade-off is complexity:

- Award availability

- Transfer rules

- Travel dates flexibility

If you want “set it and forget it,” cash back is usually better.

Avoid these reward traps

- Overspending to earn points (the easiest way to lose money)

- Carrying interest (interest charges can erase rewards quickly)

- Complicated category rules you forget

- Rewards expiration (less common now, but still exists in some programs)

- Redemption friction (if it’s annoying, you won’t redeem)

A practical rewards setup for most people

- 1 card: 2% cash back on everything

- 1 card: 3%–5% in your top category (groceries or dining) Optional:

- a travel points card only if you travel enough to use it

If you never want to think about it again: choose cash back, automate payments, and keep it simple.