0% APR vs. Balance Transfer Cards: Which One Saves You More?

Not every “0%” offer is the same. Learn how intro APR, balance transfer fees, and payoff timelines change your total cost—and how to pick the right card for your situation.

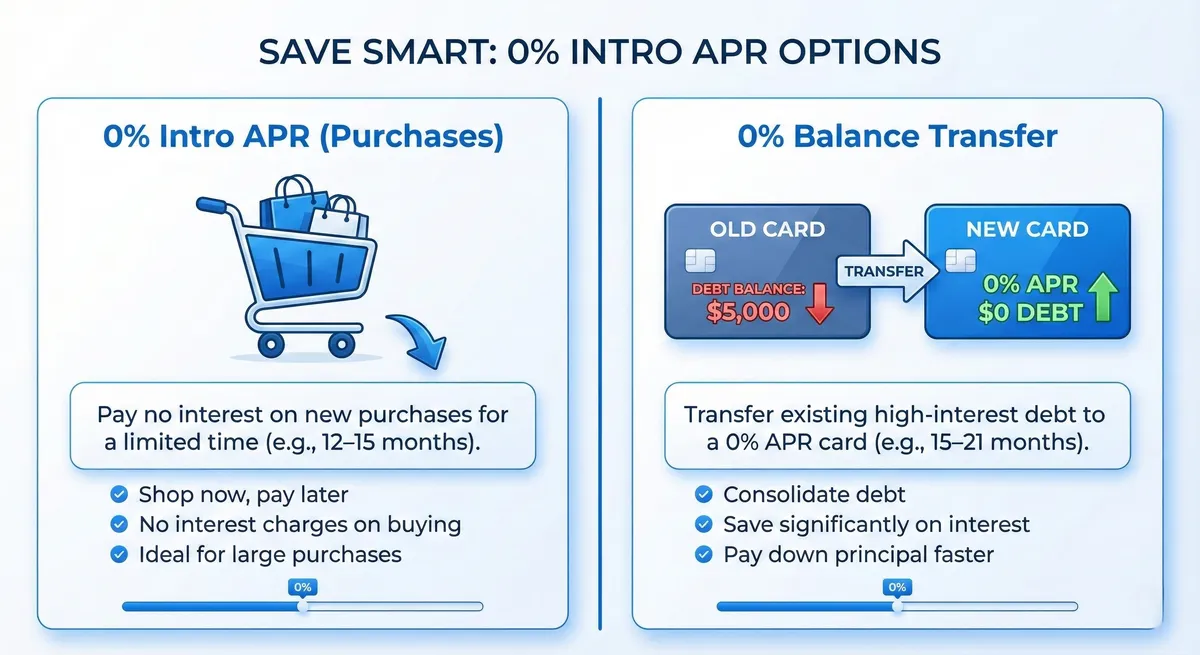

In credit cards, the phrase “0% APR” can mean two different money-saving tools:

- 0% Intro APR on Purchases (great if you need time to pay for a big expense)

- 0% Intro APR on Balance Transfers (great if you already have debt on another card)

They overlap, but they’re not the same product. The right choice depends on your goal: financing a purchase vs. eliminating existing high-interest debt.

Step 1: Define the problem (purchase financing vs. debt rescue)

Choose a 0% purchase APR card if:

- You’re planning a large purchase (appliance, travel, moving costs)

- You want a predictable payoff plan over 6–18 months

- You can avoid carrying a balance after the promo period

Choose a balance transfer card if:

- You already have credit card debt at a high APR

- You want to stop interest from compounding while you pay it down

- You have a strong chance of approval and can pay aggressively during the promo window

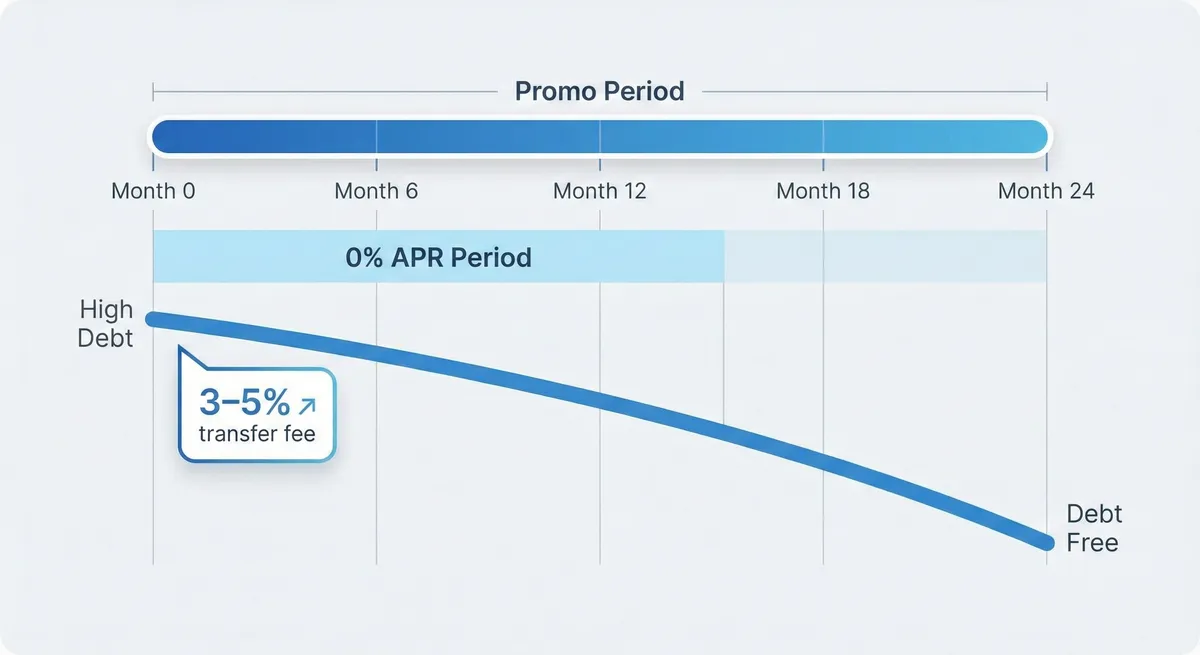

Step 2: Understand the hidden cost — the balance transfer fee

Most balance transfer offers charge a one-time transfer fee, usually 3%–5% of the amount moved.

Example:

- Transfer amount: $5,000

- Fee: 4%

- Cost: $200 (added to your balance)

That fee can still be worth it if you’re escaping interest that would have cost much more.

Step 3: A simple break-even rule (fast mental math)

A quick way to decide if a balance transfer is worth it:

- If your current APR is around 20%+, you’re paying roughly ~1.6%+ per month in interest (very rough).

- A 3%–5% transfer fee can be “earned back” in 2–4 months of avoided interest for many people.

If you can’t pay down meaningfully during the promo window, a balance transfer may only delay the problem.

Step 4: The payoff timeline that actually works

The “promo window” strategy

- Transfer (or start purchases)

- Divide balance by promo months

- Set autopay for that number

- Don’t miss payments (late payments can end promo terms)

Example payoff plan

- Balance: $6,000

- Promo: 15 months

- Target payment: $400/month (plus any fee added)

Step 5: Watch these traps (they’re common)

1) Promo APR applies to one thing, not everything

Some cards offer 0% on purchases but not transfers (or vice versa). Confirm both.

2) Deferred interest vs. true 0% APR

Most major cards use true 0% intro APR. But always confirm you’re not in a “deferred interest” structure.

3) New purchases can complicate transfers

If your card has a balance transfer and you keep spending on it, you may lose the clean payoff logic. Best practice:

- Use the card only for the transfer, and do purchases elsewhere until paid off.

4) Utilization spike can drop your score (temporarily)

A big transfer can increase utilization on the new card. This often improves as you pay down.

Step 6: Which one should you pick?

Pick 0% intro APR on purchases when:

- You need to spread a purchase over time

- You can commit to a monthly payoff schedule

- You want clean budgeting

Pick a balance transfer card when:

- You’re paying high interest right now

- You can pay down aggressively

- You accept the one-time fee as the price of stopping interest

Quick checklist before you apply

- ✅ Promo length (months)

- ✅ Transfer fee %

- ✅ Ongoing APR after promo

- ✅ Approval likelihood (credit profile)

- ✅ Your monthly payoff budget

- ✅ Plan to avoid new debt while paying this off

If you want the lowest total cost, the winning move is usually simple: stop interest first, then pay down fast.