Balance Transfer Offers: The 0% APR Paydown Playbook (Fees, Timing, and Traps)

A balance transfer can stop interest and accelerate payoff, but transfer fees, promo windows, and spending habits determine whether it’s a real win. Here’s how to do it correctly.

A balance transfer moves debt from a high-APR card to a new card—often with a 0% intro APR for a fixed period. Used correctly, it can save hundreds (or thousands) in interest. Used incorrectly, it can become a “pause button” that makes debt last longer.

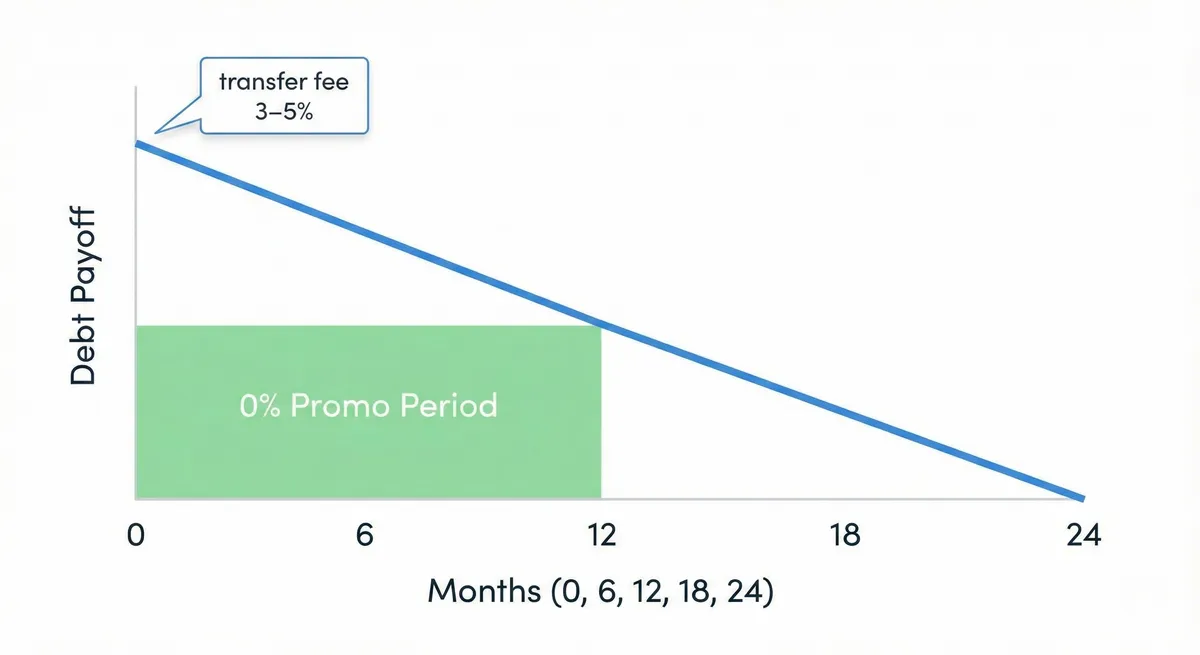

Step 1: Know the real cost — the transfer fee

Most cards charge 3%–5% of the amount transferred.

Example:

- Transfer $8,000

- Fee 4% = $320 That fee can still be worth it if you’re escaping high interest.

Step 2: Build your payoff number (the one that matters)

Calculate the monthly payment required to finish inside the promo window:

Monthly payment = (Transferred balance + fee) ÷ promo months

Example:

- $8,000 balance + $320 fee = $8,320

- Promo: 16 months

- Payment target: $520/month

If that payment is unrealistic, the transfer may not solve the core issue.

Step 3: The “don’t make it worse” rules

Rule A: Stop new debt while you pay this down

If you keep spending on credit while transferring, you’re often digging a second hole.

Rule B: Don’t mix purchases with the transfer

Some issuers apply payments in ways that can leave purchases accruing interest. Best practice: Use the transfer card only for the transfer until paid off.

Rule C: Set autopay

A late payment can:

- end the promo APR

- trigger penalty APR

- damage your score

Step 4: Watch for these balance-transfer traps

Trap 1: Promo ends sooner than you think

The intro rate is time-limited. If you still have a balance after the promo, your APR can jump.

Trap 2: Transfer limits

You may not get a high enough credit limit to move all the debt. That’s normal.

Trap 3: “Transfer within X days”

Some offers require you to complete the transfer early (like within 60 days). Check terms.

Step 5: When balance transfers are most powerful

- You have stable income

- You can commit to a payoff plan

- Your existing APR is high

- You’re ready to stop revolving balances

Step 6: If you can’t pay it off inside the promo window

You have options:

- make bigger payments early (best)

- move leftover to a low-interest loan (sometimes)

- plan a second transfer (risky and not guaranteed)

- focus on income/expense changes to increase payoff

The simplest balance-transfer success plan

- Transfer the balance

- Divide by promo months

- Autopay that amount

- Freeze discretionary credit spending

- Celebrate when your interest hits $0

Balance transfers work best when you treat them like a deadline—not a delay.