Auto Insurance Coverage Explained: Liability, Full Coverage, Deductibles, and Limits

Confused by “full coverage”? Learn what liability, collision, and comprehensive actually mean, how deductibles change your bill, and how to choose coverage limits that protect your savings.

Auto insurance is easy to buy and surprisingly easy to misunderstand. Most drivers think “full coverage” is a single product, but it’s actually a bundle of coverages with different rules, deductibles, and limits. If you pick the wrong combination, you might save $15/month and lose $15,000 when the wrong accident happens.

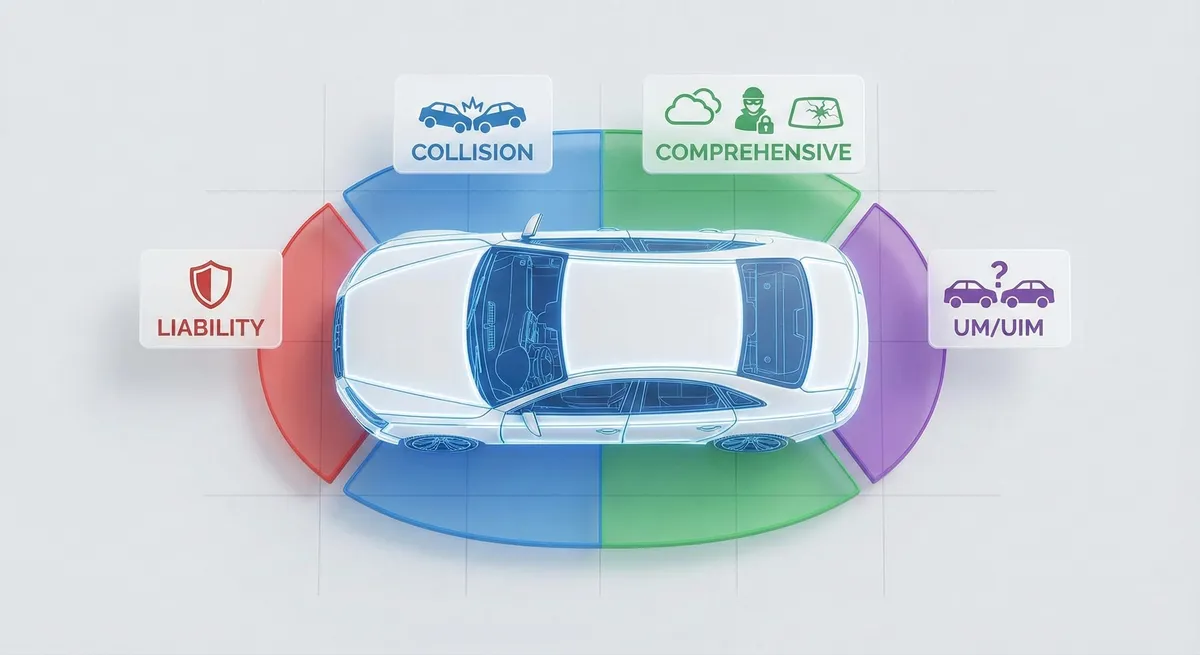

The 3 Core Coverages (and What They Really Pay For)

1) Liability (Bodily Injury & Property Damage)

Liability pays for damage and injuries you cause to others. It does not pay for your own car. This is the foundation of every policy and usually required by law.

- Bodily Injury (BI): Medical bills, lost wages, and legal costs for others if you’re at fault.

- Property Damage (PD): Repairs to the other vehicle, fences, storefronts, etc.

2) Collision

Collision pays to repair or replace your car after a crash, regardless of fault (after your deductible). This matters most if your vehicle is worth enough that replacing it would hurt.

3) Comprehensive

Comprehensive covers non-collision losses: theft, vandalism, hail, falling objects, flood, animal strikes, and more (also subject to a deductible). If you live in a hail-prone area or park outside often, this coverage can be a lifesaver.

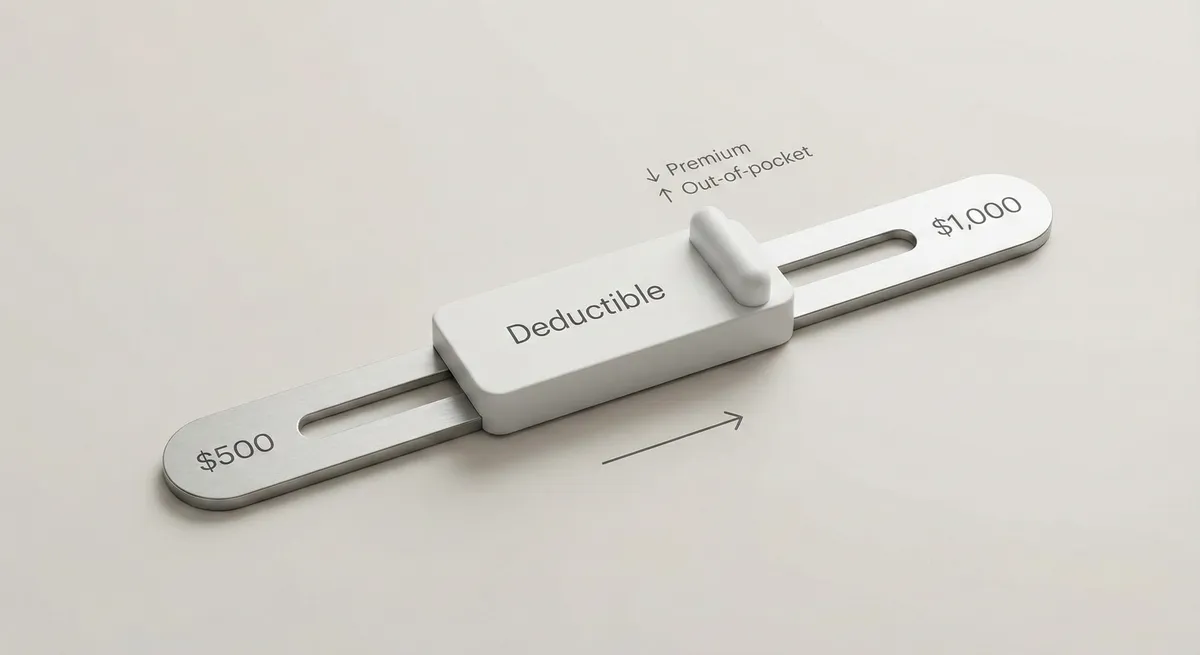

Deductibles: The Most Mispriced Decision on Your Policy

Your deductible is what you pay out of pocket before collision or comprehensive coverage starts paying. A higher deductible usually lowers your premium — but only if you can actually afford the deductible on a bad day.

- $500 deductible: Higher premium, lower out-of-pocket in a claim.

- $1,000 deductible: Lower premium, but you must be ready to pay $1,000 quickly.

Practical rule: Choose a deductible you could pay today without using a credit card. If that’s not possible, you didn’t “save money” — you just delayed the cost.

How to Pick Liability Limits (A Simple Framework)

Limits often look like 25/50/25 or 100/300/100 (BI per person / BI per accident / PD). The best limit isn’t the minimum. It’s the limit that protects your assets if the accident is expensive.

- If you have savings/assets: prioritize stronger BI/PD limits.

- If you drive in dense cities: PD can matter more (expensive cars, property damage, multi-car accidents).

- If you want extra safety: consider an umbrella policy once your auto limits are healthy.

Optional Coverages That Matter More Than People Think

- Uninsured/Underinsured Motorist (UM/UIM): protects you if the other driver has little or no coverage.

- Medical Payments / PIP: helps with medical costs regardless of fault (rules vary by state).

- Rental reimbursement: keeps you mobile while your car is repaired.

- Roadside assistance: convenient, but compare cost vs. an auto club membership.

- GAP insurance: critical if you owe more than your car is worth (common with new cars/low down payments).

What “Full Coverage” Should Mean (In Plain English)

Most people mean: solid liability limits + collision + comprehensive. The correct setup depends on your vehicle value, your emergency fund, your loan/lease requirements, and your risk tolerance.

Quick Checklist Before You Buy

- Do my liability limits protect my savings if a major accident happens?

- Can I comfortably pay my chosen deductible without stress?

- Is my car value high enough that collision/comprehensive make sense?

- Do I need UM/UIM because of my area’s uninsured driver rate?